11

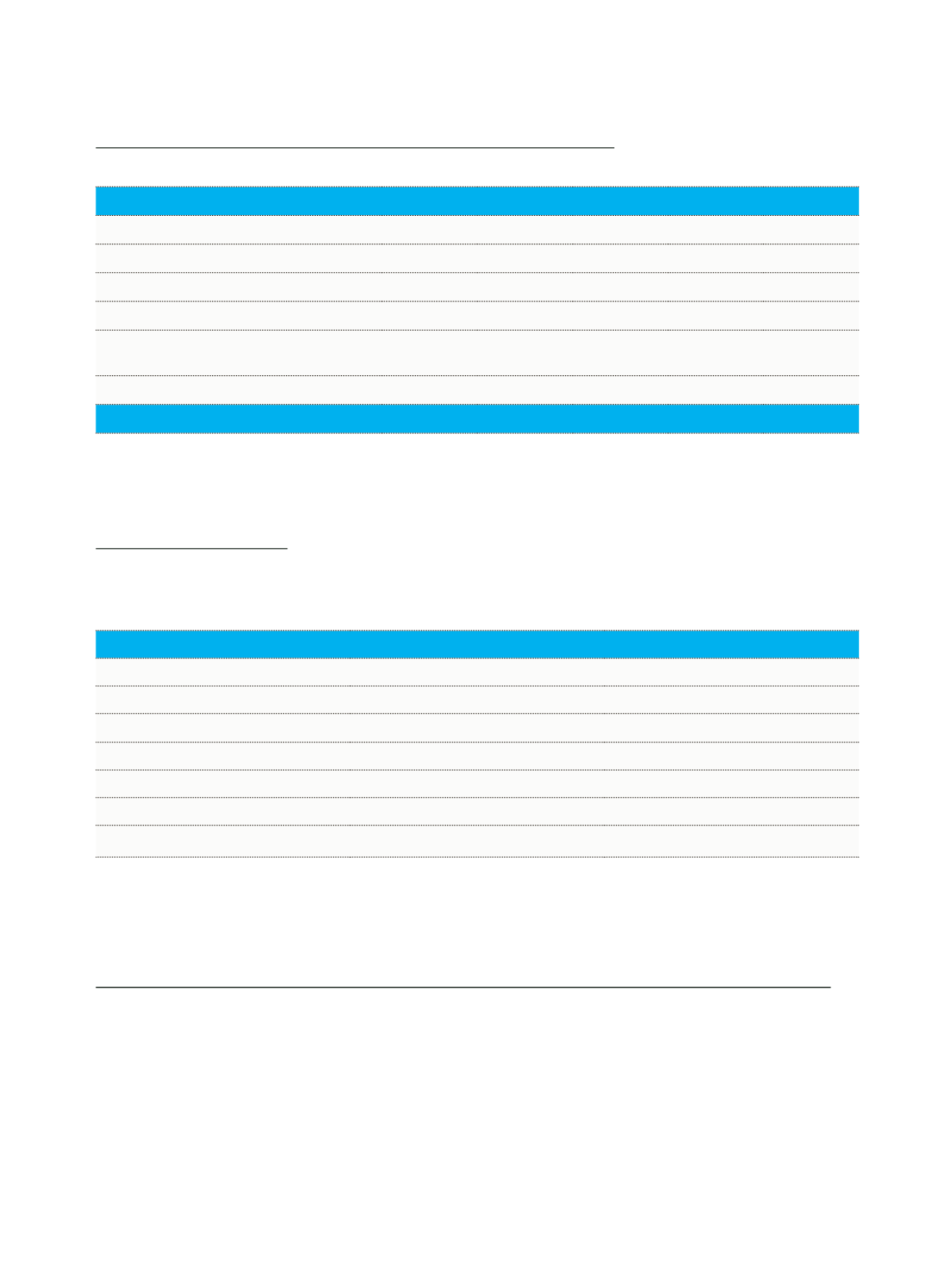

GENERAL INFORMATION

(TL Thousand)

2011

2012

2013

2014

2015

Total Assets

3,012,586 2,748,287 3,351,680 3,716,720 4,023,292

Marketable Securities Portfolio (Net)

358,730

328,566

275,035

306,267

491,288

Loans and Receivables

878,446

736,309 1,447,771 1,364,298 1,357,903

Deposits

1,946,223 1,029,738 2,686,759 3,107,733 3,347,716

Funds Borrowed and Interbank Money

Market

669,323 1,256,861

148,346

9,819

6,866

Shareholders’ Equity

353,977

412,677

461,977

532,187

601,823

NET PROFIT

48,095

59,625

49,590

70,506

70,106

The credit ratings assigned to the Bank by the international credit rating agency Fitch Ratings are as follows:

Type of Rating

Rating*

Outlook

Long-Term Foreign Currency IDR

BB-

Stable

Long-Term Local Currency IDR

BB-

Stable

Short-Term Foreign Currency IDR

B

Stable

Short-Term Local Currency IDR

B

Stable

Viability Rating

bb-

Support Rating

5

National Long-Term Rating

A+ (tur)

With a strategic focus on the corporate banking segment, A&T Bank conducted research and development activities in

line with the target of providing new products and services. As a result of these efforts, the Tax and Invoice Collection

System commenced operation in fourth quarter 2015.

In addition, the Bank continues to improve the Internet Banking channel based on technological advances and customer

feedback.

In 2016, A&T Bank will concentrate on studies to introduce technology friendly new products and distribution channels

like Mobile Banking and Customer Relationship Management (CRM) and continue to strengthen its technological

infrastructure and ensure the automation of workflows.

SUMMARY FINANCIAL HIGHLIGHTS FOR THE PAST FIVE YEARS

RATINGS OF THE BANK

RESEARCH AND DEVELOPMENT IMPLEMENTATIONS FOR NEW SERVICES AND ACTIVITIES

* Ratings of A&T Bank were affirmed on January 12, 2016.