9

GENERAL INFORMATION

Liabilities

As of 2015-end, 15% and 85% of

the Bank’s total liabilities comprise

from shareholders’ equity and

external resources, respectively. The

most significant part of the external

resources belongs to deposits at

TL 3,347.7 million.

As of year-end 2015, compared

to the previous period, the most

important increases the Bank

posted in total liabilities were

in deposits, which were up

TL 240 million, and in shareholders’

equity, which rose TL 69.6 million.

Meanwhile, significant decrease was

seen in other external resources,

which fell TL 5.6 million.

The breakdown of deposits is as

follows:

Banks deposits: 84.8% share

at TL 2,838.6 million; Client

deposits: 15.2% share at

TL 509.1 million;

Time deposits: 75.4% share at

TL 2,523.3 million; Demand

deposits: 24.6% share at

TL 824.4 million;

TL deposits: 1.9% share at

TL 62.3 million; FC deposits:

98.1% share at TL 3,285.4

million.

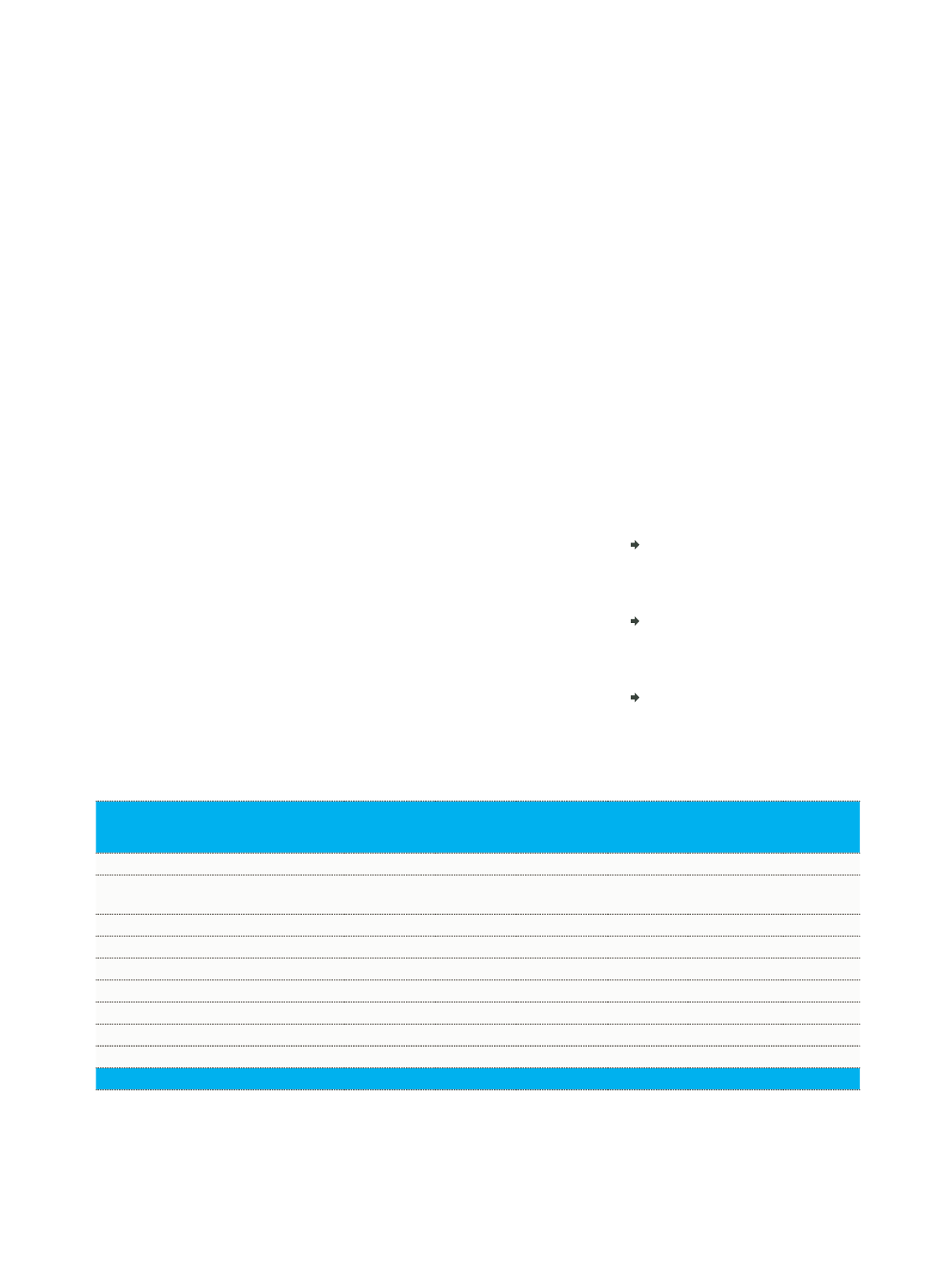

LIABILITIES (TL Thousand)

2014

Share

(%)

2015

Share

(%)

Change

(Amount)

Change

(%)

Deposits

3,107,733

83.6 3,347,716

83.2

239,983

7.7

Derivative Financial Liabilities Held

for Trading

187

0.0

753

0.0

566 302.7

Funds Borrowed

6,884

0.2

3,373

0.1

-3,511

-51.0

Interbank Money Market

2,935

0.1

3,493

0.1

558

19.0

Miscellaneous Payables

1,227

0.0

1,012

0.0

-215

-17.5

Other External Resources

19,575

0.5

13,950

0.3

-5,625

-28.7

Provisions

38,893

1.1

39,645

1.0

752

1.9

Tax Liability

7,099

0.2

11,527

0.3

4,428

62.4

Shareholders’ Equity

532,187

14.3 601,823

15.0

69,636

13.1

TOTAL LIABILITIES

3,716,720 100.0 4,023,292 100.0 306,572

8.2