107

Convenience Translation of Publicly Announced Unconsolidated Financial

Statements Originally Issued in Turkish, See Note I of Section Three

Arap Türk Bankası A.Ş.

Notes to Unconsolidated Financial

Statements at 31 December 2014

( Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated. )

General Information

Corporate Management

Financial Information

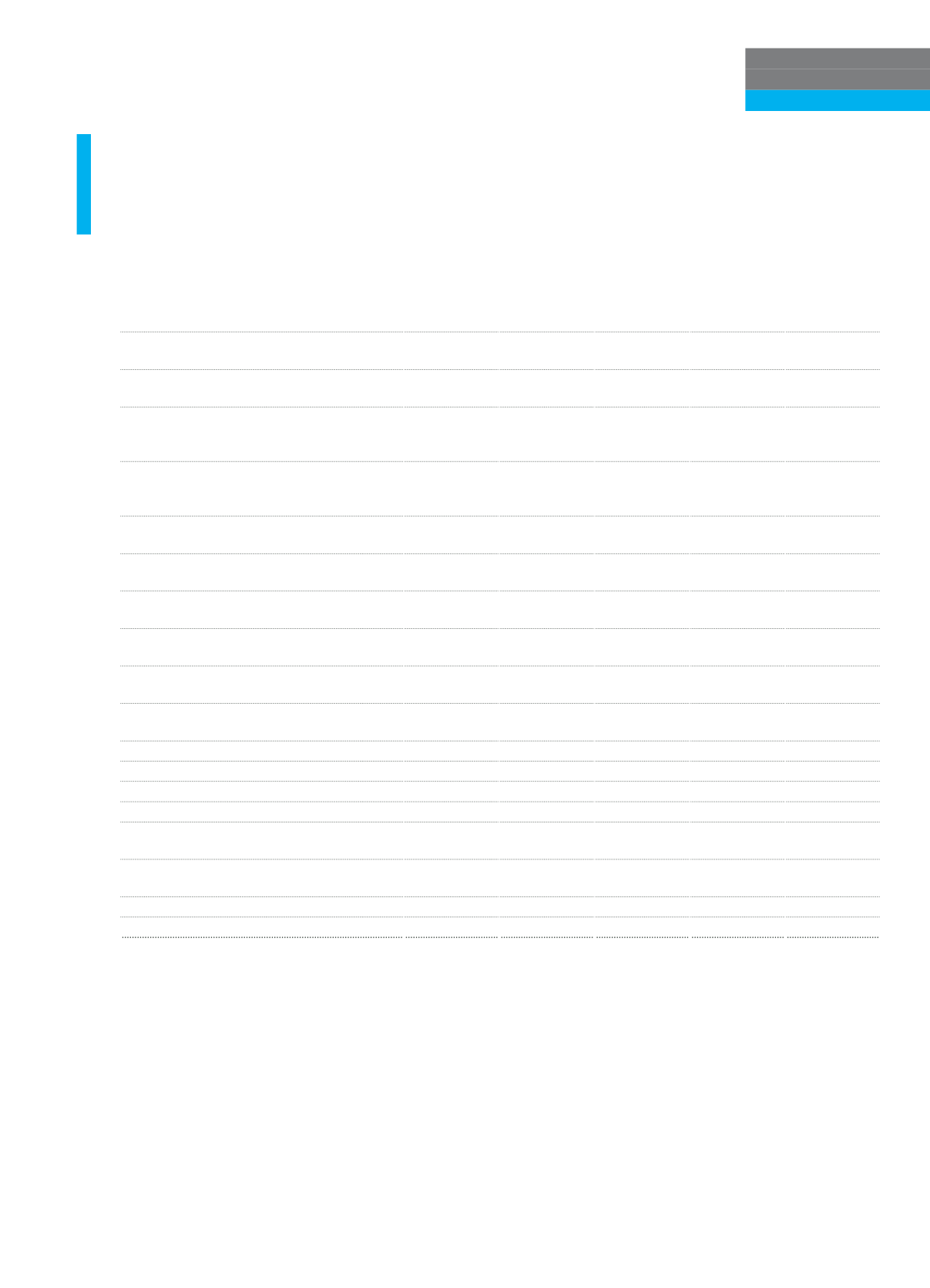

10. Presentation of maturity risk bearing based on their outstanding maturities

Payment Term

Risk Classifications

1

Month

1-3

Month

3-6

Month

6-12

Month

1 Year and

Over

Contingent and Non-Contingent Receivables

from Central Governments and Central Banks

-

19,046

1,423

4,034

91,231

Contingent and Non-Contingent Receivables

from Regional Governments and Local

Authorities

-

-

-

-

-

Contingent and Non-Contingent Receivables

from Administrative Units and Non-commercial

Enterprises

-

-

-

-

-

Contingent and Non-Contingent Receivables

fromMultilateral Development Banks

-

-

-

-

-

Contingent and Non-Contingent Receivables

from International Organizations

-

-

-

-

-

Contingent and Non-Contingent Receivables

from Banks and Financial Intermediaries

1,766,214

393,633

98,056

110,773

288,405

Contingent and Non-Contingent Corporate

Receivables

316,160

224,703

212,384

452,329

267,352

Contingent and Non-Contingent Retail

Receivables

-

-

-

-

-

Contingent and Non-Contingent Receivables

Secured by Residential Property

508

21,475

11,636

1,727

21,402

Past Due Loans

-

-

-

-

-

Higher-Risk Receivables Defined by BRSA

40,550

151,143

25,950

576

988

Marketable Securities Collateralized Mortgages

-

-

-

-

-

Securitization Exposures

-

-

-

-

-

Short-Term Receivables from Banks and

Corporate

-

-

-

-

-

Undertakings for Collective Investments in Mutual

Funds

-

-

-

-

-

Other Receivables

-

-

-

-

-

Total

2,123,432

810,000

349,449

569,439

669,378