111

Convenience Translation of Publicly Announced Unconsolidated Financial

Statements Originally Issued in Turkish, See Note I of Section Three

Arap Türk Bankası A.Ş.

Notes to Unconsolidated Financial

Statements at 31 December 2014

( Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated. )

General Information

Corporate Management

Financial Information

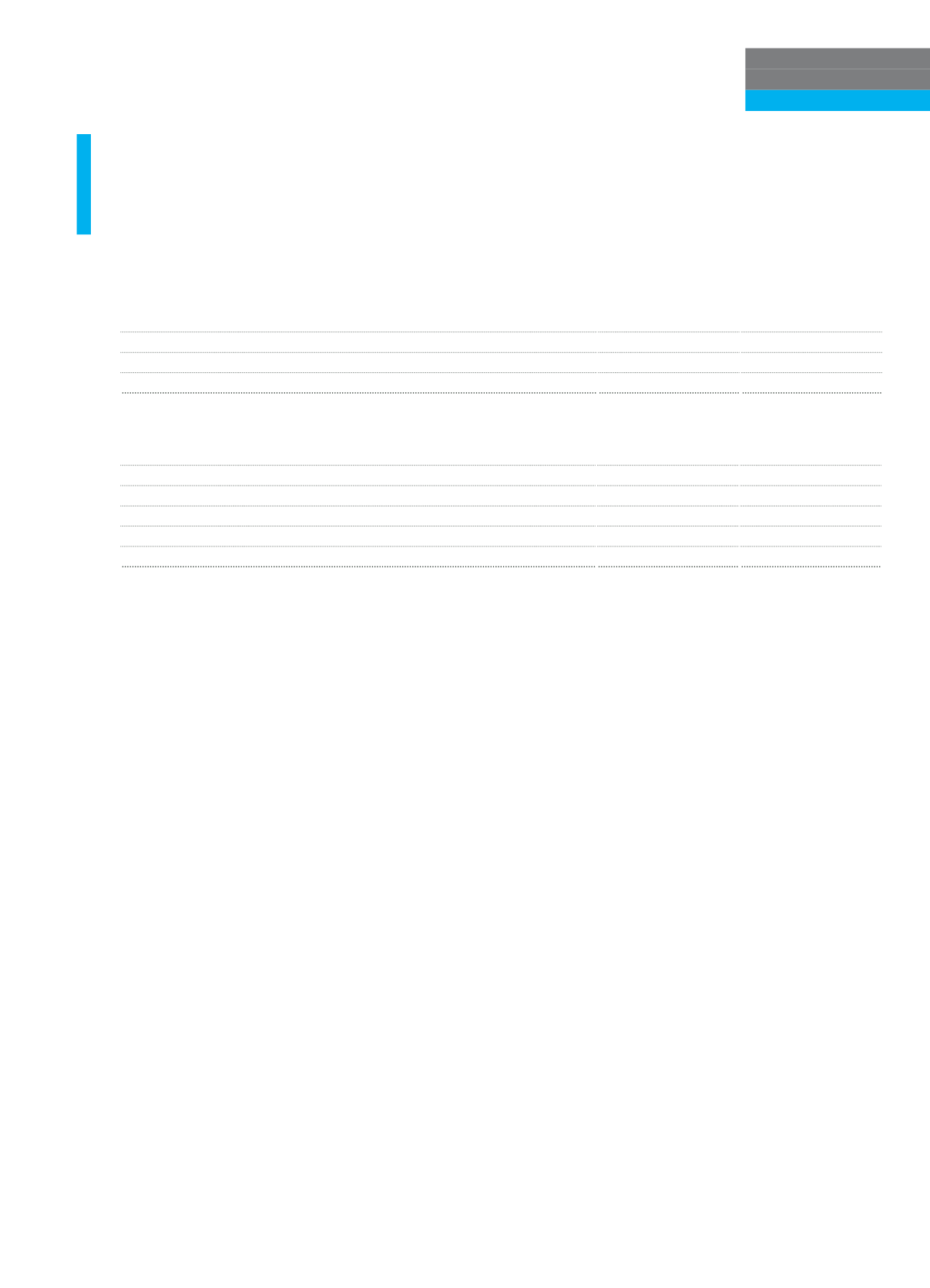

Past due but not impaired loans and receivables

Current Period

Prior Period

Degree 1: Low risk loans and receivables

-

-

Degree 2:close monitoring loans and receivables

-

2,410

Total

-

2,410

Past due but not impaired loans and receivables aging

Current Period

Prior Period

0-30 days

-

-

30-60 days

-

-

60-90 days

-

2,410

90 days or more

-

-

Total

-

2,410

III. INFORMATION ON MARKET RISK

Bank’s operations about risk management are carried out complying with “Regulation on Bank’s regulation about internal systems” and

“Regulation on Measurement and Evaluation of Capital Adequacy of Banks”.

To be in compliance with governances, Bank has regulated its operations about market risk management within the scope of

“Regulation on Internal Systems of Banks” and “Regulation on Measurement and Evaluation of Capital Adequacy of Banks” published

in Official Journal No 28337 as of 28 June 2012 lastly.

To implement methods of risk managements’ policy, strategy, implementations that approved by board of directors; to report bank’s

potential important risks to board of directors on time and accurately, internal control about units, to evaluate risk and internal auditing

reports and to correct risks, faults, inadequacies occurred in those units or to take necessary measures and to be incorporate into

process of determining risk limits are in charge of senior management.

Board of Directors is reviewing efficiency of risk management systems through the agency of auditing committee, other relevant

committees, senior management and also in consideration of various risk reports and evaluations made by auditing committee.

Risk policies and methods of implementations which are determined for market risk that bank is exposed to, is approved by board of

directors and being reviewed regularly. Market risk is managed by the way of measuring, limiting risks in compliance with international

standards and putting capital aside according to those results.

Risk Management Department is analyzing and calculating bank interest rate in consideration of various dimensions within the scope

of market risk management operations.

Interest rate and currency risk is being measured within the scope of market risk that calculated according to standard method and

included to calculation of capital requirement standard ratio.

Besides of standard method, value at risk method (VRM) is used for calculating changes in risk factors and its’ effects on bank portfolio.

Subjected method is tested by retrospective test method.

Stress tests are made to analyze the possible effects of Interest and rate fluctuations on bank on a monthly basis.