101

FINANCIAL INFORMATION

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO UNCONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

11. Information on risk classes

Assigned credit rating agencies and export credit agencies changed the names and the reasons for these organizations

The Bank uses the announced ratings of international credit rating agency Fitch Ratings and OECD for receivables from

central governments and central banks. The Bank does not use credit rating for the domestic domicile counterparties.

With the export credit agency of a credit rating agency assigned to each risk classes are used

The Bank uses Fitch Ratings for receivables from central governments, central banks and foreign domicile receivables.

The Bank uses the country risk classification of OEFD, if these counterparties do not rated by Fitch Ratings.

The Bank does not use credit rating for the domestic resident customers and banks.

The absence of the credit rating of trading for items that are not included in the calculation, instead of the credit rating

of the issuer, or if there is for export of these items that are available for information on the process of using credit ratings

For the short term receivables that has been issued by banks and financial intermediaries that has not any short term

rating, risk weight of the issuer is used in the context of related regulation.

Assigned to each grade credit rating agencies and export credit agency ratings of the Regulation on Measurement and

Assessment of Capital Adequacy of Banks to which of the credit quality of the stages

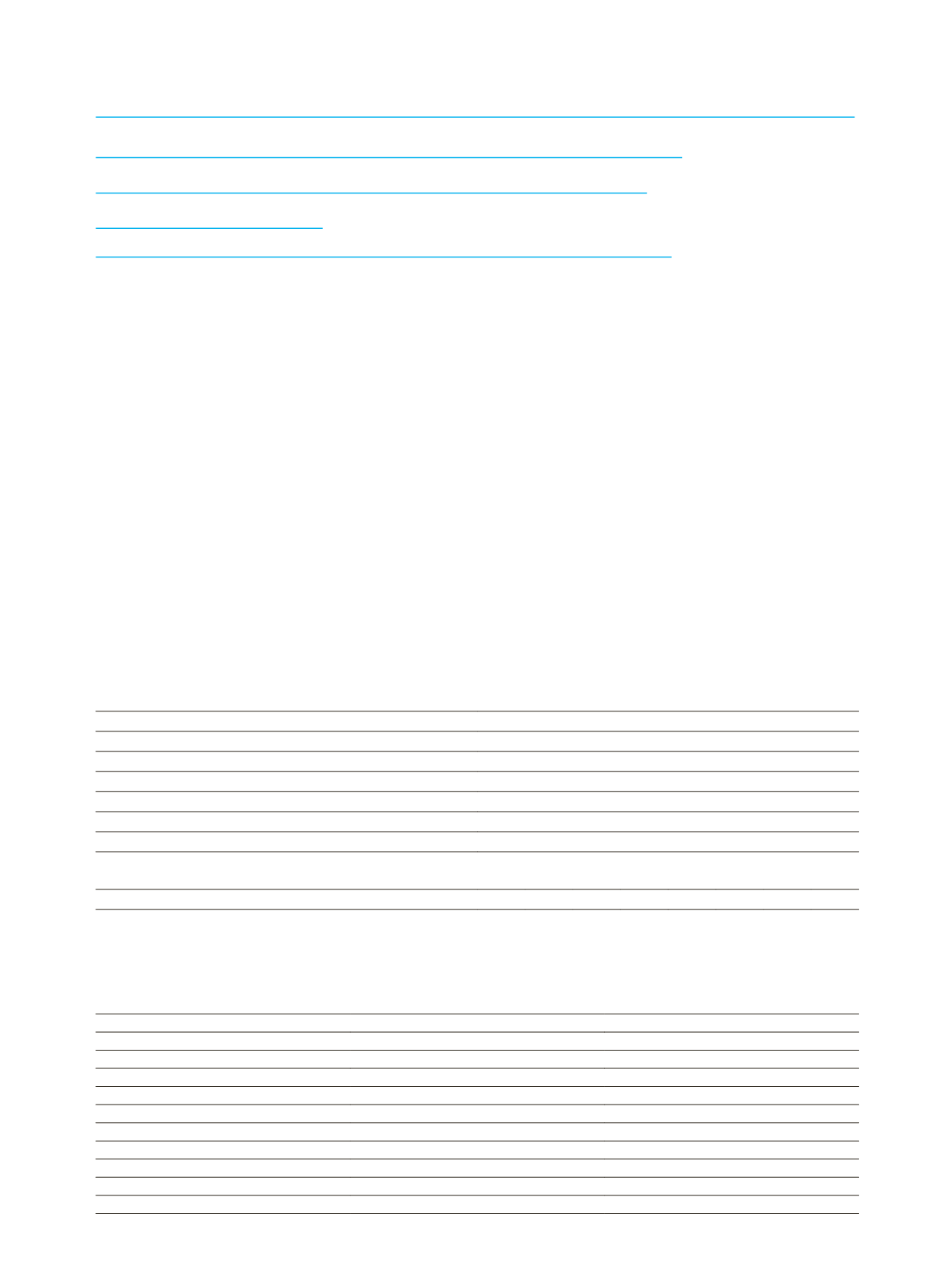

Credit Quality Level

Fitch Ratings

1

Between AAA and AA-

2

Between A+ and A-

3

Between BBB+ and BBB-

4

Between BB+ and BB-

5

Between B+ and B-

6

Between CCC+ and below

OECD Country Risk Classification Credit Quality Levels

0 1 2 3 4 5 6 7

Risk weight (%)

0 0 20 50 100 100 100 150

Risk weight of the total amount of risk before and after credit risk mitigation and equity deducted amounts

Risk amount based on weight of risks

Risk weights

Before credit risk mitigation

After credit risk mitigation

0%

862,023

862,023

10%

-

-

20%

466,996

466,996

50%

2,304,004

2,269,238

75%

-

-

100%

1,528,308

1,519,020

150%

174,069

52,011

200%

-

-

1250%

-

-

Equity Deductions

-

-