7

General Information

Corporate Management

Financial Information

Liabilities

As of 2014-end, 14.3% and 85.7% of the Bank’s total liabilities

comprise from shareholders’ equity and external resources,

respectively. The most significant part of the external resources

belongs to deposits at TL 3,107.7 million.

As of year-end 2014, compared to the previous period, the

most important increases the Bank posted in total liabilities

were in deposits, which were up TL 421 million, and in

shareholders’ equity, which rose TL 70.2 million. Meanwhile,

significant decreases were seen in funds borrowed, which fell

TL 105 million, and in interbank money market, which dipped

TL 33.6 million.

The breakdown of deposits is as follows:

• Banks deposits: 81.7% share at TL 2,538 million;

Client deposits: 18.3% share at TL 569.7 million;

• Time deposits: 74.1% share at TL 2,302.2 million;

Demand deposits: 25.9% share at TL 805.5 million;

• TL deposits: 1.7% share at TL 52 million;

FC deposits: 98.3% share at TL 3,055.7 million.

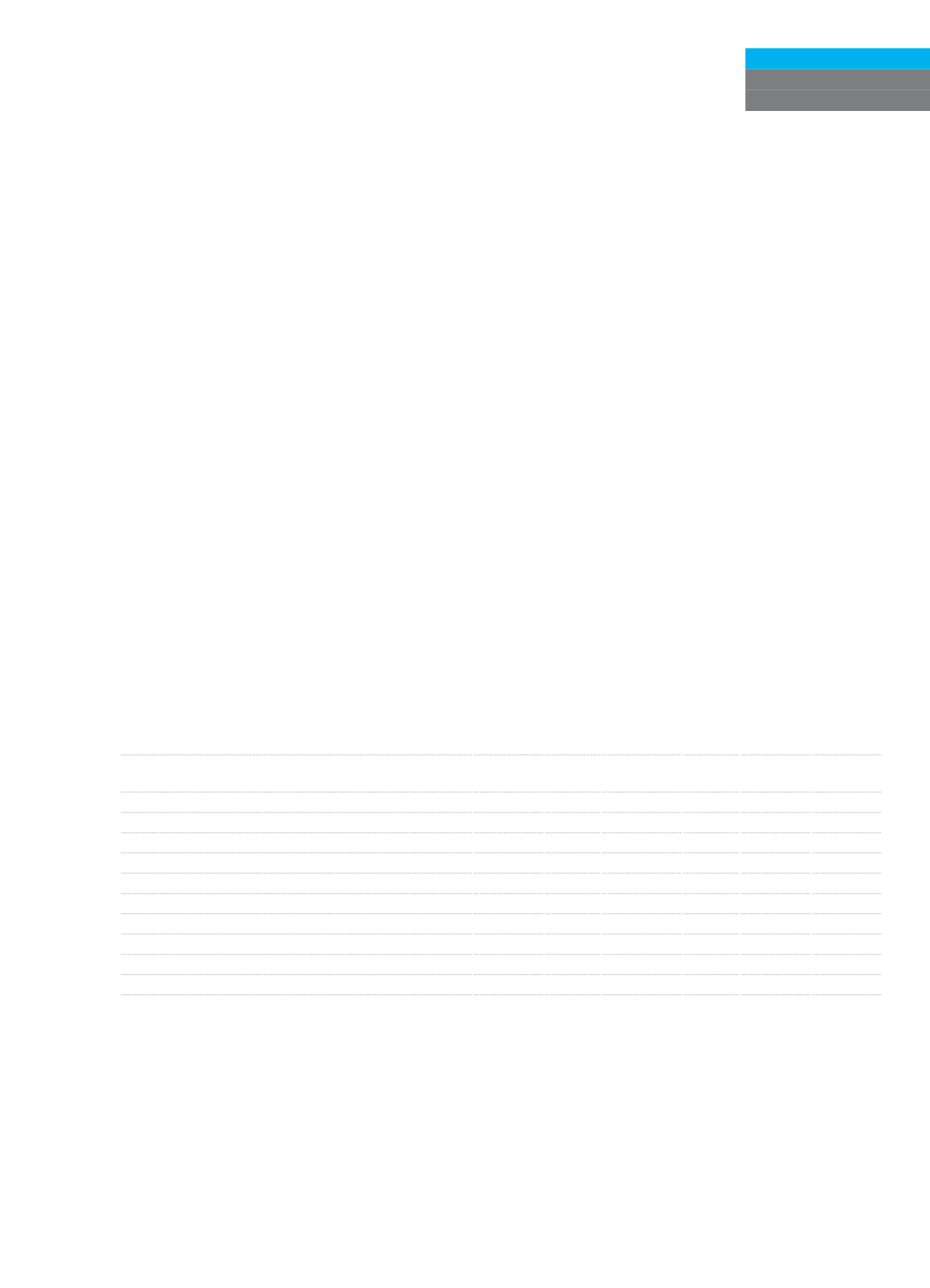

LIABILITIES (TL Thousand)

2013

Share

(%)

2014

Share

(%)

Change

(Amount)

Change

(%)

Deposits

2,686,759 80.2 3,107,733 83.6 420,974

15.7

Derivative Financial Liabilities Held for Trading

0

0.0

187

0.0

187

-

Funds Borrowed

111,838

3.3

6,884

0.2 -104,954

-93.8

Interbank Money Market

36,508

1.1

2,935

0.1 -33,573

-92.0

Miscellaneous Payables

1,523

0.0

1,227

0.0

-296

-19.4

Other External Resources

18,290

0.5

19,575

0.5 1,285

7.0

Provisions

28,625

0.9

38,893

1.1 10,268

35.9

Tax Liability

6,160

0.2

7,099

0.2

939

15.2

Shareholders’ Equity

461,977 13.8 532,187 14.3 70,210

15.2

TOTAL LIABILITIES

3,351,680 100.0 3,716,720 100.0 365,040 10.9