73

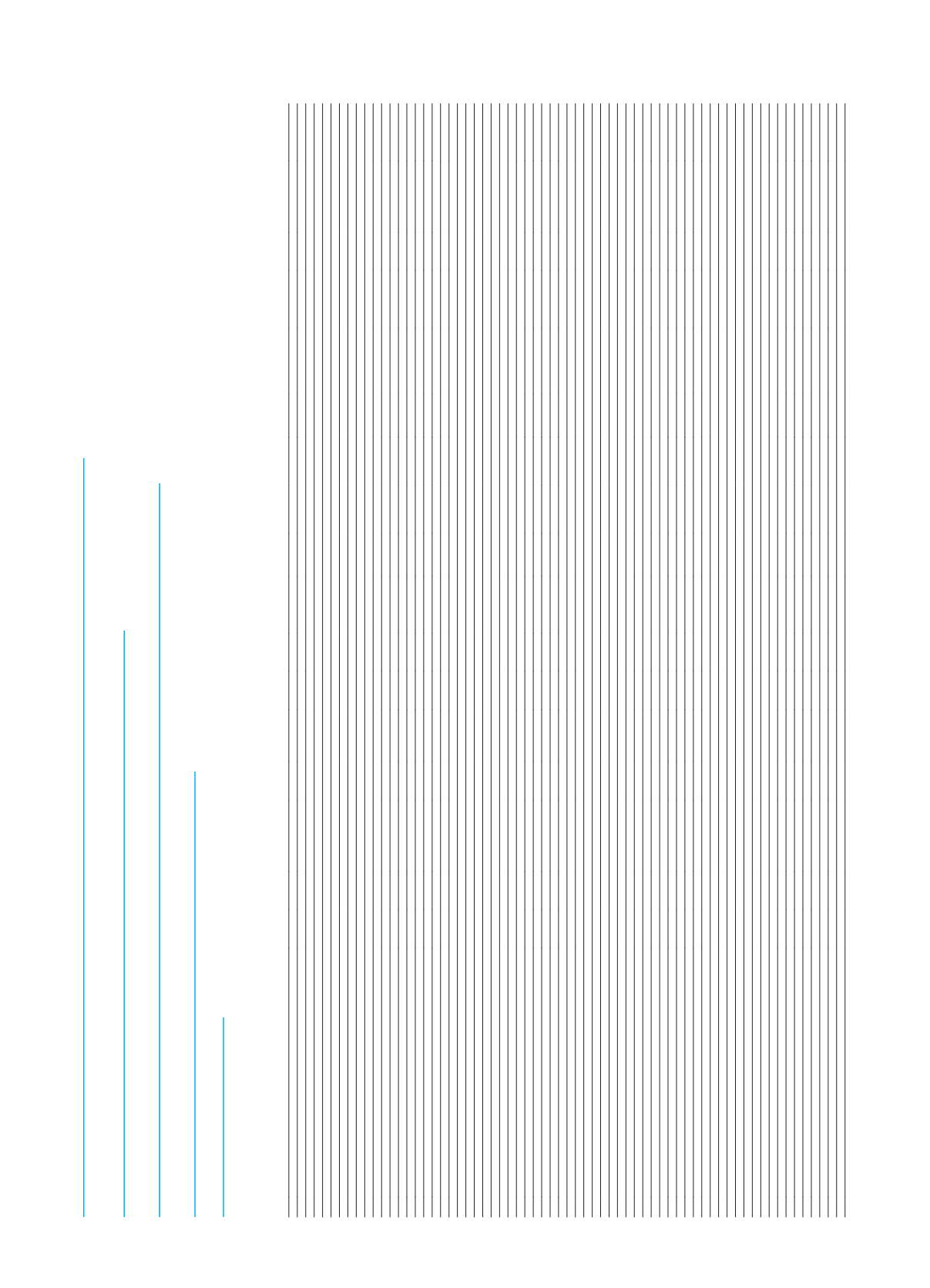

FINANCIAL INFORMATION

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

STATEMENT OF CHANGES IN UNCONSOLIDATED SHAREHOLDERS’ EQUITY

FOR THE PERIOD ENDED 31 DECEMBER 2015

(THOUSANDS OF TURKISH LIRA)

STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

Footnotes

(5-V)

Paid-in

Capital l

Capital Reserves

from Inflation

Adjustments

to Paid in Capital

Share

premium

Share

Cancellation

Profits

Legal

Reserves

Status

Reserves

Extraordinary

Reserves

Other

Reserves

Current

Period

Net Profit/

Loss

Prior

Period

Net Profit/

Loss

Securities

Value

Increase

Fund

Revaluation

Surplus on

Tangible and

Intangible Assets

Bonus Shares

of Equity

Participations

Hedging

Reserve

Accu. Rev.Surp.

on Assets Held for

Sale and Assets of

Discont. Op.s

Total

Shareholders’

Equity

PRIOR PERIOD (31/12/2014)

I.

Balances at the beginning of the period

240.000

9.096

-

-

9.130

-

-

(1.364)

49.590

155.525

-

-

-

-

-

461.977

II.

Corrections made as per TAS 8

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

2.1 Effects of corrections

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

2.2 Effects of changes in accounting policies

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

III.

Adjusted balances at the beginning of the period (I+II)

240.000

9.096

-

-

9.130

-

-

(1.364)

49.590

155.525

-

-

-

-

-

461.977

Changes during the period

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

IV.

Mergers

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

V.

Securities Value Increase Fund

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

VI. Hedges for Risk Management

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

6.1 Net Cash Flow Hedges

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

6.2 Net Foreign Investment Hedges

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

VII. Revaluation surplus on tangible assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

VIII. Revaluation surplus on intangible assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

IX. Bonus shares of associates, subsidiaries and joint ventures

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

X.

Foreign exchange differences

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XI. Changes resulted from disposal of assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XII. Changes resulted from reclassification of assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XIII. Effect of change in equities of associates on Bank's Equity

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XIV. Capital increase

(7) 200.000

(9.096)

-

-

-

-

-

-

- (190.904)

-

-

-

-

-

-

14.1 Cash

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

14.2 Internal sources

200.000

(9.096)

-

-

-

-

-

-

- (190.904)

-

-

-

-

-

-

XV. Share issuance

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XVI. Share cancellation profits

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XVII. Capital Reserves From Inflation Adjustments To Paid-in Capital

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XVIII.Others

-

-

-

-

-

-

-

(296)

-

-

-

-

-

-

-

(296)

XIX. Current Period Net Profit

-

-

-

-

-

-

-

-

70.506

-

-

-

-

-

-

70.506

XX. Profit distribution

-

-

-

-

2.533

-

-

-

(49.590)

47.057

-

-

-

-

-

-

20.1 Dividends distributed

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

20.2 Transfers to Reserves

-

-

-

-

2.533

-

-

-

(49.590)

47.057

-

-

-

-

-

-

20.3 Others

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Balances at end of period (III+IV+V+……+XVIII+XIX+XX)

440.000

-

-

- 11.663

-

-

(1.660)

70.506

11.678

-

-

-

-

-

532.187

CURRENT PERIOD (31/12/2015)

I.

Balances at end of prior period

440.000

-

-

- 11.663

-

-

(1.660)

70.506

11.678

-

-

-

-

-

532.187

Changes within the period

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

II.

Mergers

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

III.

Securities Value Increase Fund

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

IV.

Hedges for Risk Management

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

4.1 Net Cash Flow Hedges

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

4.2 Net Foreign Investment Hedges

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

V.

Revaluation surplus on tangible assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

VI. Revaluation surplus on intangible assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

VII. Bonus shares of associates, subsidiaries and joint ventures

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

VIII. Foreign exchange differences

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

IX. Changes resulted from disposal of assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

X.

Changes resulted from reclassification of assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XI. Effect of change in equities of associates on Bank's Equity

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XII. Capital increase

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

12.1 Cash

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

12.2 Internal sources

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XIII. Share issuance

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XIV. Share cancellation profits

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XV. Capital Reserves From Inflation Adjustments To Paid-in Capital

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XVI. Others

-

-

-

-

-

-

-

(471)

-

-

-

-

-

-

-

(471)

XVII. Current Period Net Profit

-

-

-

-

-

-

-

-

70.106

-

-

-

-

-

-

70.106

XVIII. Profit distribution

-

-

-

-

3.526

-

-

-

(70.506)

66.981

-

-

-

-

-

1

18.1 Dividends distributed

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

18.2 Transfers to legal reserves

(6)

-

-

-

-

3.526

-

-

-

(70.506)

66.981

-

-

-

-

-

1

18.3 Others

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Balances at end of period (I+II+III+…+XVI+XVII+XVIII)

440.000

-

-

- 15.189

-

-

(2.131)

70.106

78.659

-

-

-

-

-

601.823

The accompanying notes are an integral part of these unconsolidated financial statements.