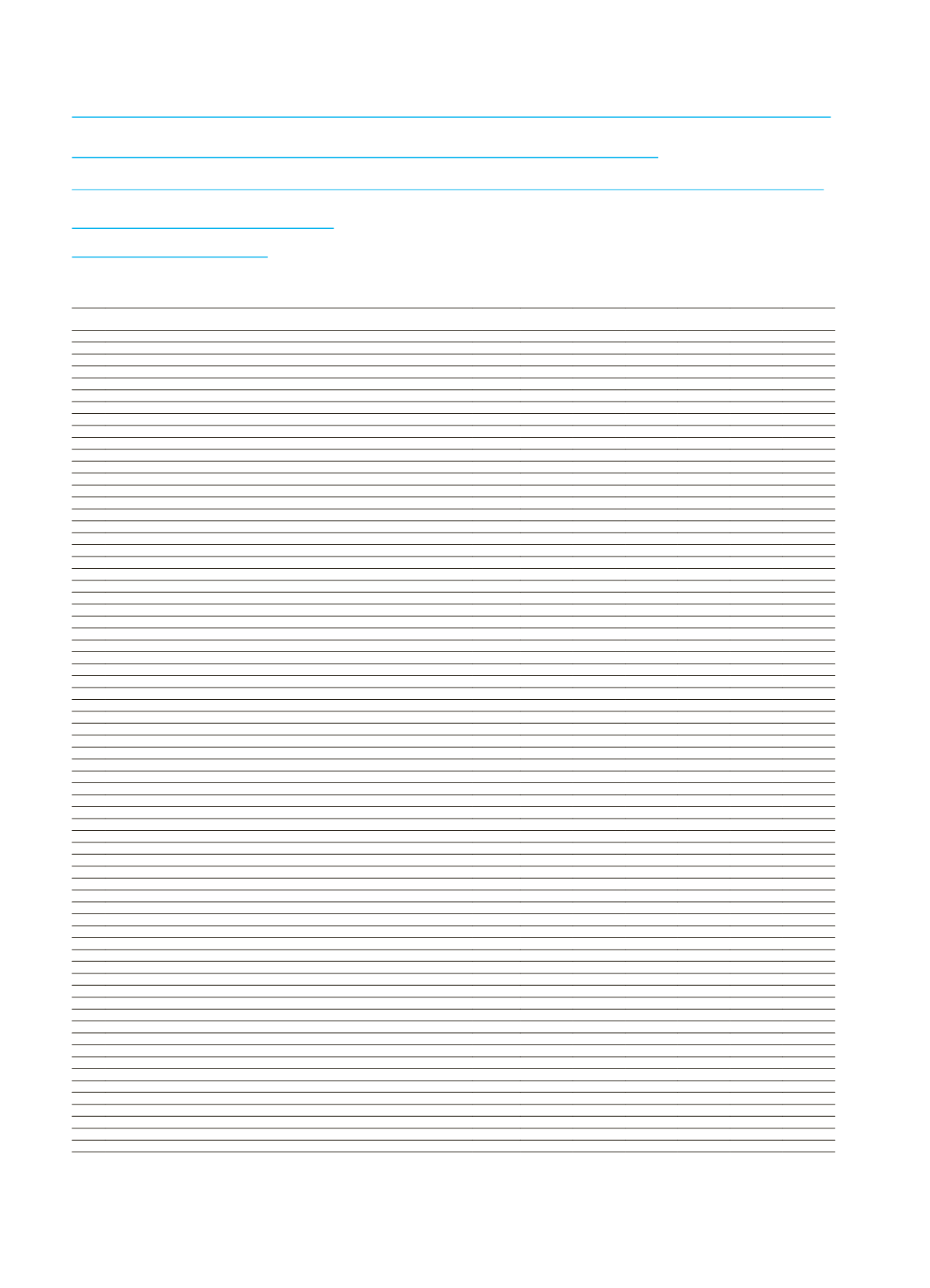

68 A&T BANK ANNUAL REPORT 2015

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

UNCONSOLIDATED BALANCE SHEET (STATEMENT OF FINANCIAL POSITION)

AS OF 31 DECEMBER 2015

(THOUSANDS OF TURKISH LIRA)

AUDITED

AUDITED

ASSETS

Footnotes

CURRENT PERIOD

(31/12/2015)

PRIOR PERIOD

(31/12/2014)

(5-I)

TL

FV

Total

TL

FC

Total

I.

CASH AND BALANCES WITH THE CENTRAL BANK OF TURKEY

(1)

8.453

849.701

858.154

6.564

347.676

354.240

II.

FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

(2)

14.220

194.122

208.342

43.716

119.715

163.431

2.1 Financial assets held for trading

14.220

194.122

208.342

43.716

119.715

163.431

2.1.1 Public sector debt securities

14.220

101.821

116.041

33.001

24.018

57.019

2.1.2 Securities representing a share in capital

-

-

-

-

-

-

2.1.3 Derivatives held for trading

-

-

-

782

-

782

2.1.4 Other marketable securities

-

92.301

92.301

9.933

95.697

105.630

2.2 Financial assets designated at fair value through profit or loss

-

-

-

-

-

-

2.2.1 Public sector debt securities

-

-

-

-

-

-

2.2.2 Equity securities

-

-

-

-

-

-

2.2.3 Loans granted

-

-

-

-

-

-

2.2.4 Other marketable securities

-

-

-

-

-

III.

BANKS

(3)

4.752 1.201.947 1.206.699

109 1.558.315 1.558.424

IV.

MONEY MARKET PLACEMENTS

-

-

-

26.908

-

26.908

4.1 Interbank money market placements

-

-

-

-

-

-

4.2 Istanbul Stock Exchange money market placements

-

-

-

-

-

-

4.3 Receivables from reverse repurchase agreements

-

-

-

26.908

-

26.908

V.

FINANCIAL ASSETS AVAILABLE FOR SALE (Net)

(4)

224

1.164

1.388

224

935

1.159

5.1 Securities representing a share in capital

224

1.164

1.388

224

935

1.159

5.2 Public sector debt securities

-

-

-

-

-

-

5.3 Other marketable securities

-

-

-

-

-

-

VI.

LOANS AND RECEIVABLES

(5)

767.109

590.794 1.357.903

663.412

700.886 1.364.298

6.1 Loans and Receivables

765.166

590.794 1.355.960

661.534

700.886 1.362.420

6.1.1 Loans granted to the Bank's risk group

-

89.650

89.650

-

36.570

36.570

6.1.2 Public sector debt securities

-

-

-

-

-

-

6.1.3 Other

765.166

501.144 1.266.310

661.534

664.316 1.325.850

6.2 Loans under follow-up

13.211

-

13.211

15.092

-

15.092

6.3 Specific provisions (-)

11.268

-

11.268

13.214

-

13.214

VII.

FACTORING RECEIVABLES

-

-

-

-

-

-

VIII.

INVESTMENTS HELD TO MATURITY (Net)

(6)

17.604

263.954

281.558

24.503

117.174

141.677

8.1 Public sector debt securities

1.038

231.020

232.058

24.503

91.232

115.735

8.2 Other marketable securities

16.566

32.934

49.500

-

25.942

25.942

IX.

INVESTMENTS IN ASSOCIATES (Net)

(7)

-

-

-

-

-

-

9.1 Consolidated by equity method

-

-

-

-

-

-

9.2 Unconsolidated associates

-

-

-

-

-

-

9.2.1 Financial investments in associates

-

-

-

-

-

-

9.2.2 Non-financial investments in associates

-

-

-

-

-

-

X.

INVESTMENTS IN SUBSIDIARIES (Net)

(8)

70.213

-

70.213

65.214

-

65.214

10.1 Financial subsidiaries

70.213

-

70.213

65.214

-

65.214

10.2 Non-financial subsidiaries

-

-

-

-

-

-

XI.

INVESTMENTS IN JOINT- VENTURES (Net)

(9)

-

-

-

-

-

-

11.1 Consolidated by equity method

-

-

-

-

-

-

11.2 Unconsolidated joint ventures

-

-

-

-

-

-

11.2.1 Financial investments in joint ventures

-

-

-

-

-

-

11.2.2 Non-financial investments in joint ventures

-

-

-

-

-

-

XII.

LEASE RECEIVABLES (Net)

(10)

-

-

-

-

-

-

12.1 Finance lease receivables

-

-

-

-

-

-

12.2 Operational leasing receivables

-

-

-

-

-

-

12.3 Other

-

-

-

-

-

-

12.4 Unearned Revenue (-)

-

-

-

-

-

-

XIII.

DERIVATIVE FINANCIAL ASSETS HELD FOR HEDGING

(11)

-

-

-

-

-

-

13.1 Fair value hedges

-

-

-

-

-

-

13.2 Cash flow hedges

-

-

-

-

-

-

13.3 Hedges for investments made in foreign countries

-

-

-

-

-

-

XIV.

TANGIBLE ASSETS (Net)

(12)

19.611

-

19.611

21.067

-

21.067

XV.

INTANGIBLE ASSETS (Net)

(13)

2.648

-

2.648

2.977

-

2.977

15.1 Goodwill

-

-

-

-

-

-

15.2 Other

2.648

-

2.648

2.977

-

2.977

XVI.

INVESTMENT PROPERTY (Net)

(14)

-

-

-

-

-

-

XVII.

TAX ASSET

(15)

2.830

-

2.830

2.080

-

2.080

17.1 Current tax asset

-

-

-

-

-

-

17.2 Deferred tax asset

2.830

-

2.830

2.080

-

2.080

XVIII. ASSET HELD FOR SALE AND ASSETS OF DISCONTINUED OPERATIONS (Net)

(16)

9

-

9

10

-

10

18.1 Held for sale purpose

9

-

9

10

-

10

18.2 Held from discontinued operations

-

-

-

-

-

-

XIX.

OTHER ASSETS

(17)

10.823

3.114

13.937

11.823

3.412

15.235

TOTAL ASSETS

918.496 3.104.796 4.023.292

868.607 2.848.113 3.716.720

The accompanying notes are an integral part of these unconsolidated financial statements.