207

FINANCIAL INFORMATION

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

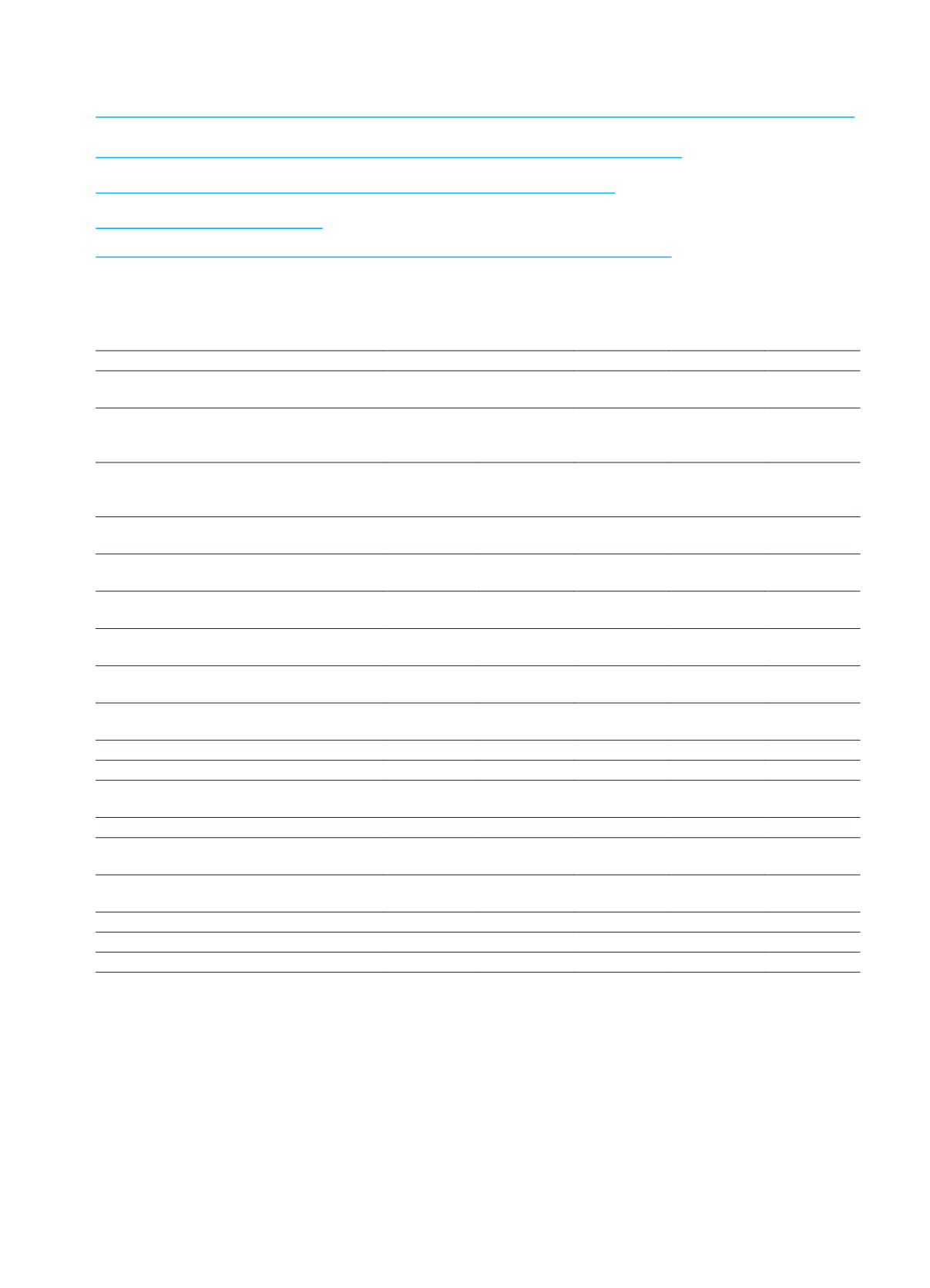

10. Presentation of maturity risk bearing based on their outstanding maturities

Days to maturity

Risk Classifications

1 Month 1-3 Month 3-6 Month 6-12 Month Over 1 year

Contingent and Non-Contingent Receivables

from Central Governments and Central Banks

853,712

93,321

-

20,673

117,025

Contingent and Non-Contingent Receivables

from Regional Governments and Local

Authorities

-

-

-

-

-

Contingent and Non-Contingent Receivables

from Administrative Units and Non-

commercial Enterprises

-

-

-

-

-

Contingent and Non-Contingent Receivables

from Multilateral Development Banks

-

-

-

-

-

Contingent and Non-Contingent Receivables

from International Organizations

-

-

-

-

-

Contingent and Non-Contingent Receivables

from Banks and Financial Intermediaries

1,509,193

465,793

204,085

62,337

360,930

Contingent and Non-Contingent Corporate

Receivables

390,396

339,893

265,370

216,410

408,309

Contingent and Non-Contingent Retail

Receivables

-

-

-

-

-

Contingent and Non-Contingent Receivables

Secured by Residential Property

1,562

8,585

20

14,538

14,496

Past Due Loans

-

-

-

-

-

Higher-Risk Receivables Defined by BRSA

60,227

96,890

4,333

11,728

891

Marketable Securities Collateralized

Mortgages

-

-

-

-

-

Securitization Exposures

-

-

-

-

-

Short-Term Receivables from Banks and

Corporate

-

-

-

-

-

Undertakings for Collective Investments in

Mutual Funds

-

-

-

-

-

Other Receivables

-

-

-

-

-

Total

2,815,090 1,004,482

473,808

325,686

901,651

11. Information on risk classes

Assigned credit rating agencies and export credit agencies changed the names and the reasons for these organizations

The Parent Bank uses the announced ratings of international credit rating agency Fitch Ratings and OECD for receivables

from central governments and central banks. The Parent Bank does not use credit rating for the domestic domicile

counterparties.

With the export credit agency of a credit rating agency assigned to each risk classes are used

The Parent Bank uses Fitch Ratings for receivables from central governments, central banks and foreign domicile

receivables. The Bank does not use credit rating for the domestic resident customers. The Bank uses the country risk

classification of OECD, if these counterparties do not rated by Fitch Ratings.

The Bank does not use credit rating for the domestic resident customers and banks.