126 A&T BANK ANNUAL REPORT 2015

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO UNCONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

The estimated fair value of the loans is calculated over the cash flows discounted using the market interest rates

implicated on the constant interest loans. The carrying values of floating-rate loans are deemed a reasonable proxy for

their fair values.

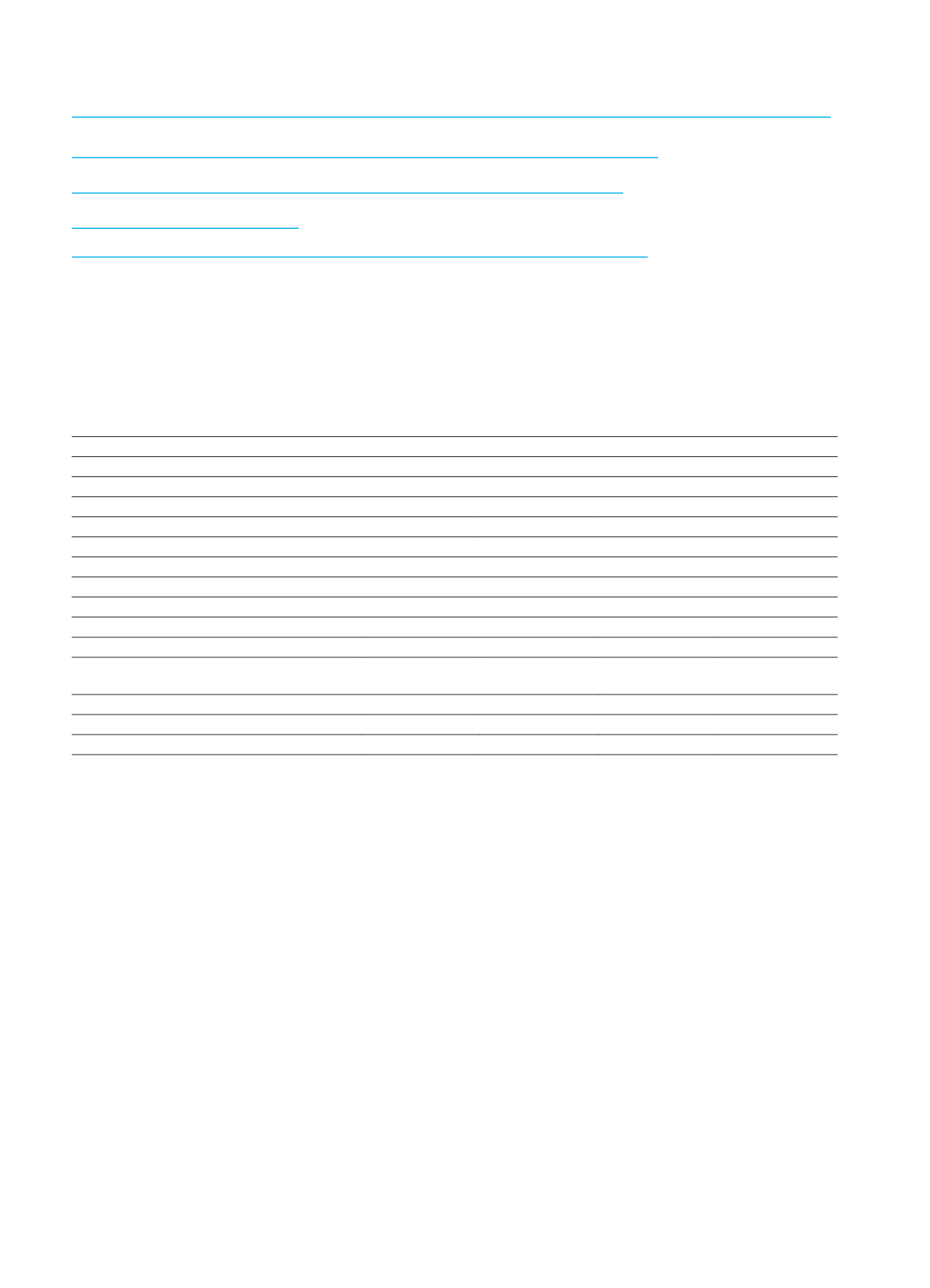

In the table below; fair values and book values of some of the financial assets and liabilities are presented. The book

value of the assets and liabilities is the total of the cost and accumulated interest accruals.

Carrying Value

Fair Value

Current Period Prior Period Current Period Prior Period

Financial Assets

2,847,548

3,092,466

2,859,078

3,106,959

Banks

1,206,699

1,558,424

1,206,699

1,558,424

Money market receivables

-

26,908

-

26,908

Financial assets available-for-sale

1,388

1,159

1,388

1,159

Investment securities held-to- maturity

281,558

141,677

293,088

156,170

Loans

1,357,903

1,364,298

1,357,903

1,364,298

Financial Liabilities

3,115,611

3,118,779

3,115,611

3,118,779

Interbank deposits

2,838,587

2,537,987

2,838,587

2,537,987

Other Deposits

509,129

569,746

509,129

569,746

Funds provided from other financial

institutions

3,373

6,884

3,373

6,884

Money market borrowings

3,493

2,935

3,493

2,935

Marketable securities issued

-

-

-

-

Miscellaneous Payables

1,012

1,227

1,012

1,227

Fair value hierarchy

The table below analyses financial instruments carried at fair value by valuation method. The different levels have been

defined as follows:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities,

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either

directly (i.e. as prices) or,

Level 3: Inputs for the asset or liability that is not based on observable market data (unobservable inputs).