119

FINANCIAL INFORMATION

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO UNCONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

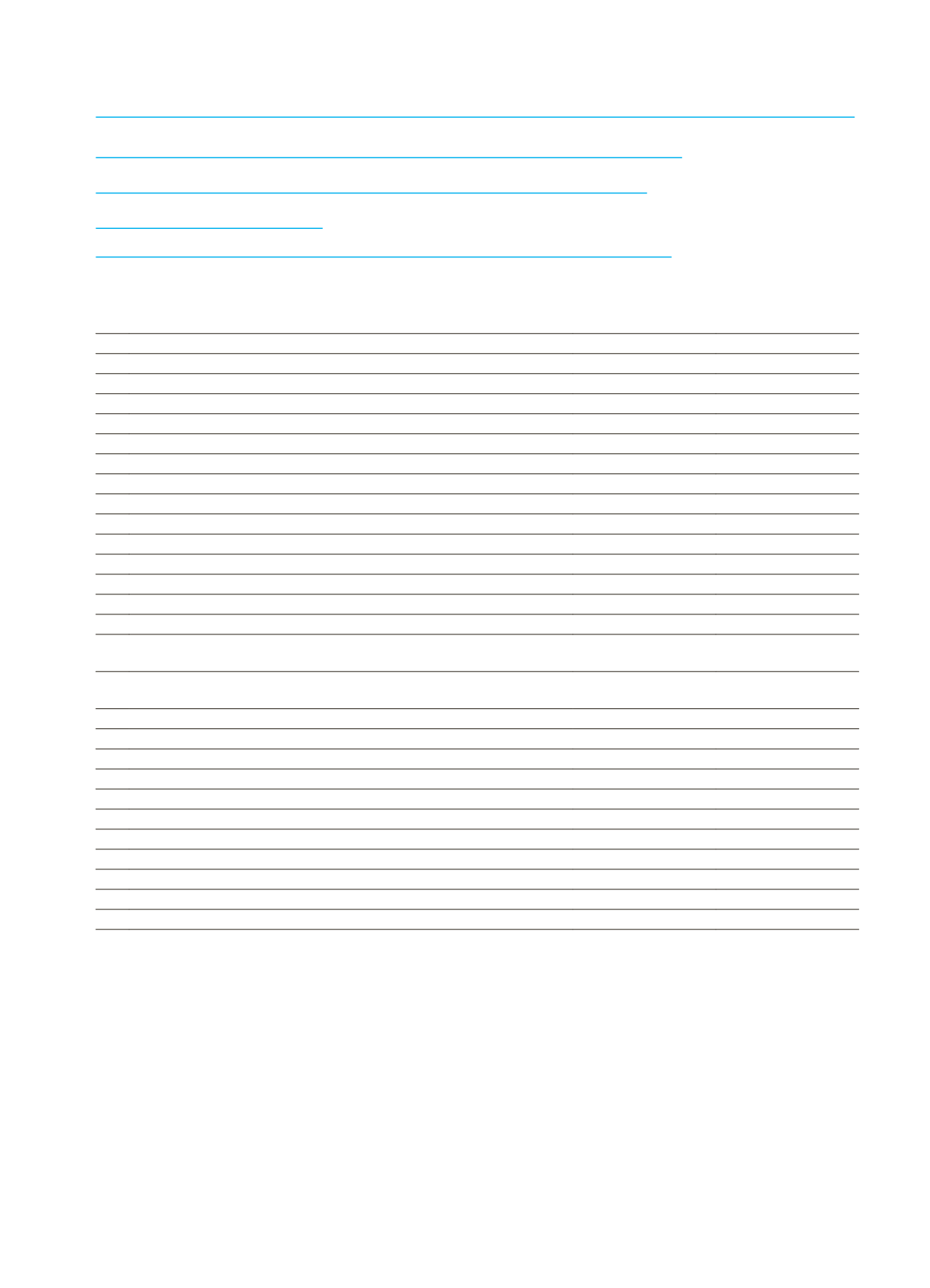

Current Period

Consideration Ratio

Applied Total Value

LC+FC

FC

HIGH QUALITY LIQUID ASSETS

1 High quality liquid assets

405,489

330,967

CASH OUTFLOWS

2 Natural person deposits and retail deposits

14,487

13,612

3 Stable deposit

4,095

3,749

4 Low stability deposit

10,392

9,863

5 Unsecured debts except natural person deposits and retail deposits

1,560,463

1,521,085

6 Operational deposit

-

-

7 Non-operating deposits

1,560,208

1,521,085

8 Other unsecured debts

255

-

9 Secured debts

-

-

10 Other cash outflows

40,332

31,202

11 Derivative liabilities and margin obligations

40,332

31,202

12 Debt from structured financial instruments

-

-

13 Other off-balance sheet liabilities and commitments for the payment

owed to financial markets

-

-

14 Revocable off-balance sheet obligations regardless of any other

requirement and other contractual obligations

118,785

110,126

15 Other irrevocable or provisory revocable off-balance sheet liabilities

3,727

2,984

16 TOTAL CASH OUTFLOW

1,737,794

1,679,009

CASH INFLOWS

17 Secured receivables

-

-

18 Unsecured claims

1,277,385

1,046,763

19 Other cash inflows

46,711

40,954

20 TOTAL CASH INFLOWS

1,324,096

1,087,717

21 TOTAL HQLA STOCK

405,489

330,967

22 TOTAL NET CASH OUTFLOWS

487,650

591,987

23 LIQUIDITY COVERAGE RATIO (%)

86.24

60.10

Important factors affecting the liquidity coverage ratio results and the change over time of those items taken

into account while calculating this ratio

High-quality liquid assets and cash outflows are one of the most important factors affecting the calculation of the

liquidity coverage ratio for banks. A major portion of high-quality liquid assets of the Bank are consisted of treasury bills

and free deposits held in CBRT. High-quality liquid assets been on the rise throughout the year had a positive effect on

the calculation of liquidity coverage ratio.

Sections High-quality liquid assets comprised of

High-quality liquid assets consist of Cash, Effectives, Debt Instruments issued by CBRT and Treasury, Debt Instruments

with a Credit or default rating from A+ to BBB- or any equivalent Debt Instruments. CBRT accounts for 66% of high-

quality liquid assets of the Bank, while 34% comprised of debt instruments issued by the Treasury.