254

A&T BANK 2014 FAALİYET RAPORU

Convenience Translation of Publicly Announced Consolidated Fınancial

Statements Originally Issued in Turkish, See Note I of Section Three

Arap Türk Bankası A.Ş.

Notes to Consolidated Financial

Statements at 31 December 2014

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

ANNU L R PORT 2014

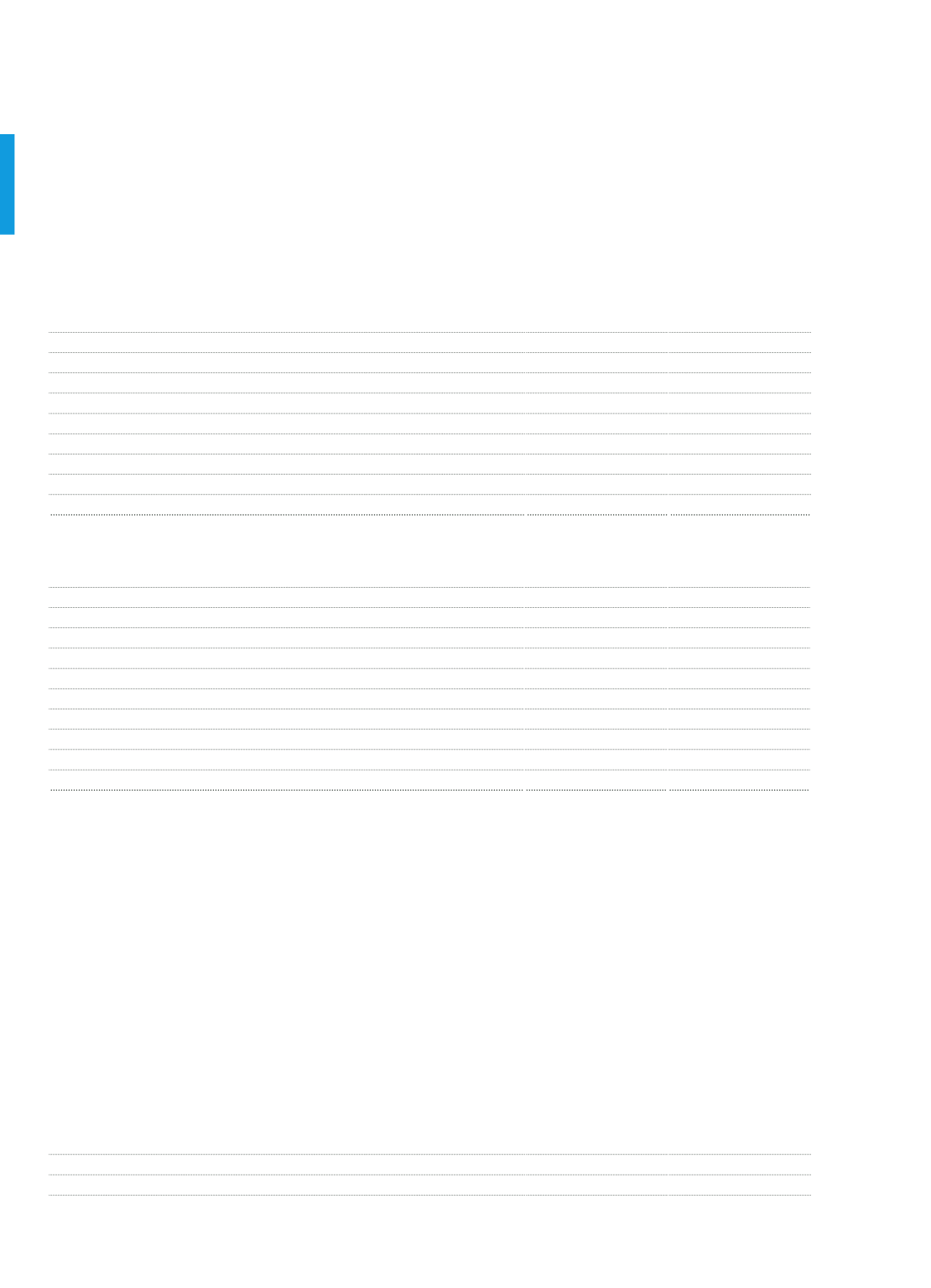

Information on tax payables

Current Period

Prior Period

Corporate Tax

3,267

3,773

Banking Insurance Transaction Tax (BITT)

612

858

Taxation of Securities

1,798

232

Value added taxes payable

81

64

Corporate tax payable-limited

5

7

Foreign Exchange Legislation Tax

-

-

Property tax

18

15

Other

893

882

Total

6,764

5,831

Information on premiums

Current Period

Prior Period

Social Security Premiums – Employee

87

212

Social Security Premiums – Employer

468

306

Bank Social Aid Pension Fund Premium – Employee

-

-

Bank Social Aid Pension Fund Premium – Employer

-

-

Pension Fund Membership Fees and Provisions – Employee

-

-

Pension Fund Membership Fees and Provisions – Employer

-

-

Unemployment Insurance – Employee share

16

15

Unemployment Insurance – Employer share

32

30

Other

-

-

Total

603

563

Information on deferred tax liability

The net amount of assets and liabilities that is calculated over the temporary differences between the applied accounting policies and

tax regulation is recorded as net deferred tax asset with an amount of TL 2,101. Detailed information on net deferred tax is presented

in footnote I-13 in Section Five.

9. Information on liabilities for assets held for sale and discontinued operation

The Parent Bank has not any liability for assets held for sale and discontinued operation.

10. Explanations on the number of subordinated loans the Bank used, maturity, interest rate, institution that loan was

borrowed from, and conversation option, if any

The Parent Bank has no subordinated loans.

11. Information on Shareholder’s Equity

Presentation of Paid-in Capital

Current Period

Prior Period

Common Stock

440,000

240,000

Preferred Stock

-

-