251

Convenience Translation of Publicly Announced Consolidated Fınancial

Statements Originally Issued in Turkish, See Note I of Section Three

Arap Türk Bankası A.Ş.

Notes to Consolidated Financial

Statements at 31 December 2014

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

General Information

Corporate Management

Financial Information

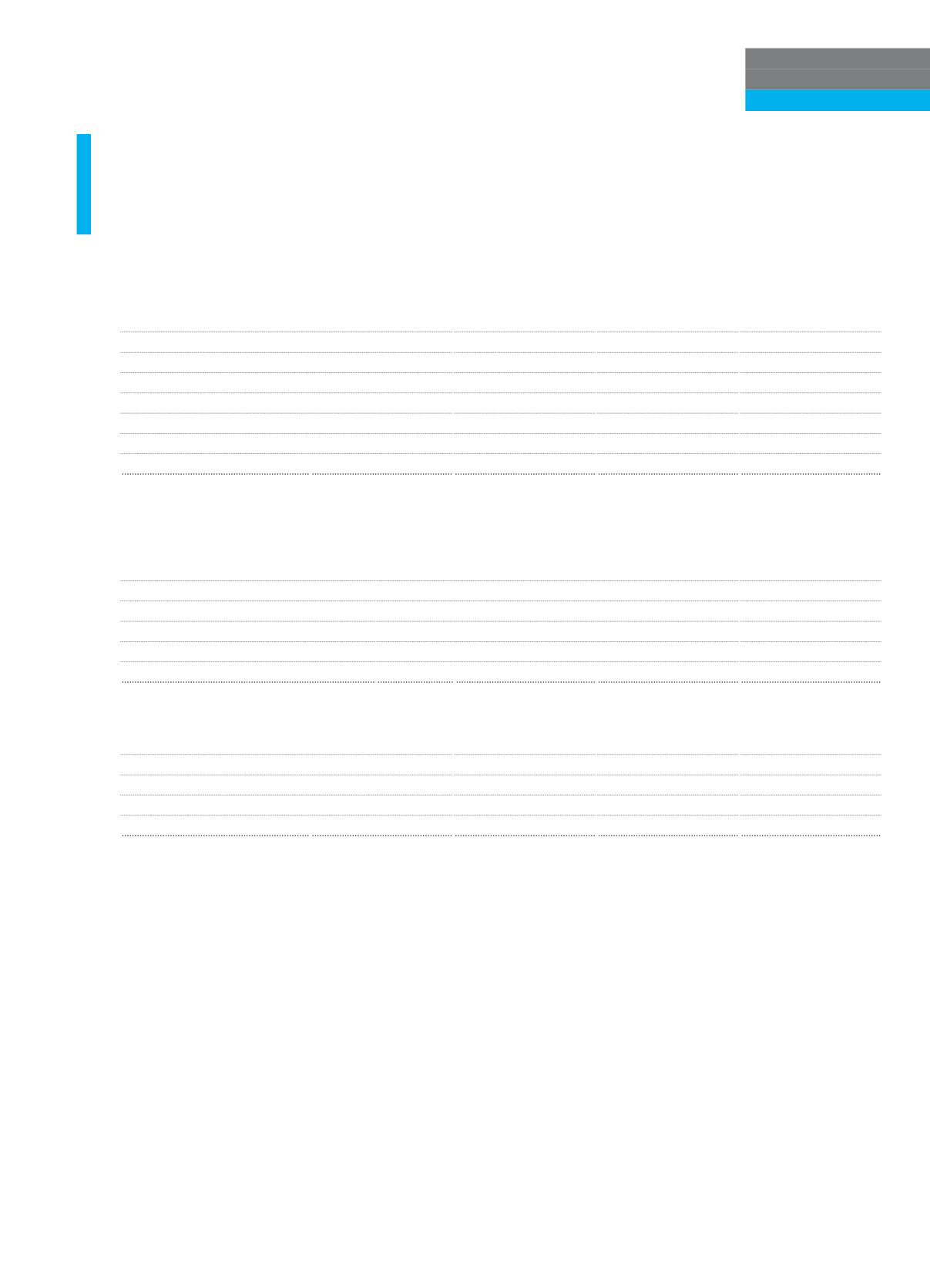

2. Information on financial derivatives through profit or loss

Current Period

Prior Period

TL

FC

TL

FC

Forward transactions

-

-

-

-

Swap transactions

187

-

-

-

Futures transactions

-

-

-

-

Options

-

-

-

-

Other

-

-

-

-

Total

187

-

-

-

3. Information on Funds Borrowed

Information on banks and other financial institutions

Current Period

Prior Period

TL

FC

TL

FC

Borrowing from Central Bank

-

-

-

-

From Domestic Banks and Institutions

6,067

72,311

7,571

29,452

From Foreign Banks, Institutions and Funds

-

103,691

-

172,865

Total

6,067

176,002

7,571

202,317

Presentation of funds borrowed based on maturity profile

Current Period

Prior Period

TL

FC

TL

FC

Short-Term

6,067

34,121

6,908

193,520

Medium and Long-Term

-

141,881

663

8,797

Total

6,067

176,002

7,571

202,317

Additional explanation related to the concentrations of the Bank’s major liabilities on the basis of concentrations, fund

providing customers, sector groups and other criteria where risk concentration is observed

Domestic borrowings consist of Eximbank loans. Borrowings from abroad consist of foreign banks.

4. Information on other foreign resources

The other external resources is amounting to TL 19,575 (31 December 2013: TL 18,290) and this amount does not exceed 10% of

the total balance sheet.

5. Information on financial lease obligations

None.

6. Information on liabilities arised from financial derivative transactions for hedging purposes

The Group does not have financial derivative instruments for hedging purposes.