243

Convenience Translation of Publicly Announced Consolidated Fınancial

Statements Originally Issued in Turkish, See Note I of Section Three

Arap Türk Bankası A.Ş.

Notes to Consolidated Financial

Statements at 31 December 2014

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

General Information

Corporate Management

Financial Information

Information on subsidiaries

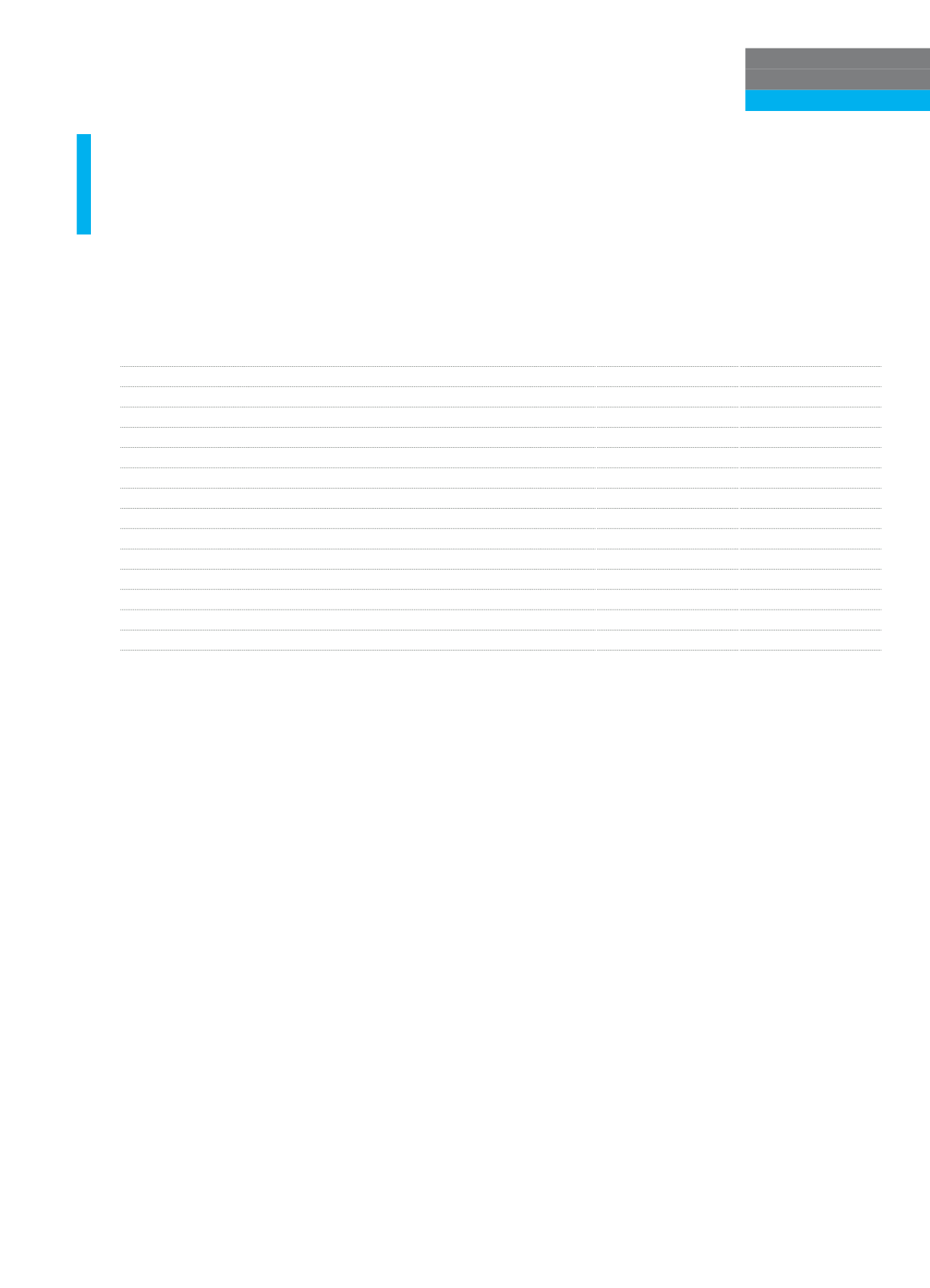

Information on Shareholder’s Equity for A&T Finansal Kiralama A.Ş.

Current Period

Prior Period

CORE CAPITAL

Paid in Capital

65,000

60,680

Effect of Inflation Adjustment on Paid in Capital

97

106

Legal Reserves

1,983

1,787

Extraordinary Reserves – Legal Reserve per General Legislation

-

3

Profit/Loss

7,477

6,052

Net Profit

5,940

2,157

Prior Period Profit/Loss

1,537

3,895

Intangible Assets (-)

202

240

Total Core Capital

74,355

68,388

SUPPLEMENTARY CAPITAL

-

-

CAPITAL

74,355

68,388

DEDUCTION FROM CAPITAL

-

-

NET AVAILABLE CAPITAL

1

74,355

68,388

1

There is no restriction on shareholders’ equity of subsidiary. After deduction from the capital, the total net available equity is TL 74,355.

There is no internal capital adequacy assessment approach for the subsidiary. There is no addiditional requirements in terms of the

capital of the subsidiary.

Summary information on basic features of equity items

Paid in capital has been indicated as Turkish Lira in articles of incorporation and registered in trade registry.

Effect of inflation adjustments on paid in capital is the difference caused by the inflation adjustment on shareholders’ equity items.

Extraordinary reserves are the status reserves which have been transferred with the General Assembly decision after distributable

profit have been transferred to legal reserves.

Legal reserves are the status reserves which have been transferred from distributable profit in accordance with the third clause of first

and second paragraph of 519 and 521 articles of Turkish Commercial Code no. 6102.