123

Convenience Translation of Publicly Announced Unconsolidated Financial

Statements Originally Issued in Turkish, See Note I of Section Three

Arap Türk Bankası A.Ş.

Notes to Unconsolidated Financial

Statements at 31 December 2014

( Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated. )

General Information

Corporate Management

Financial Information

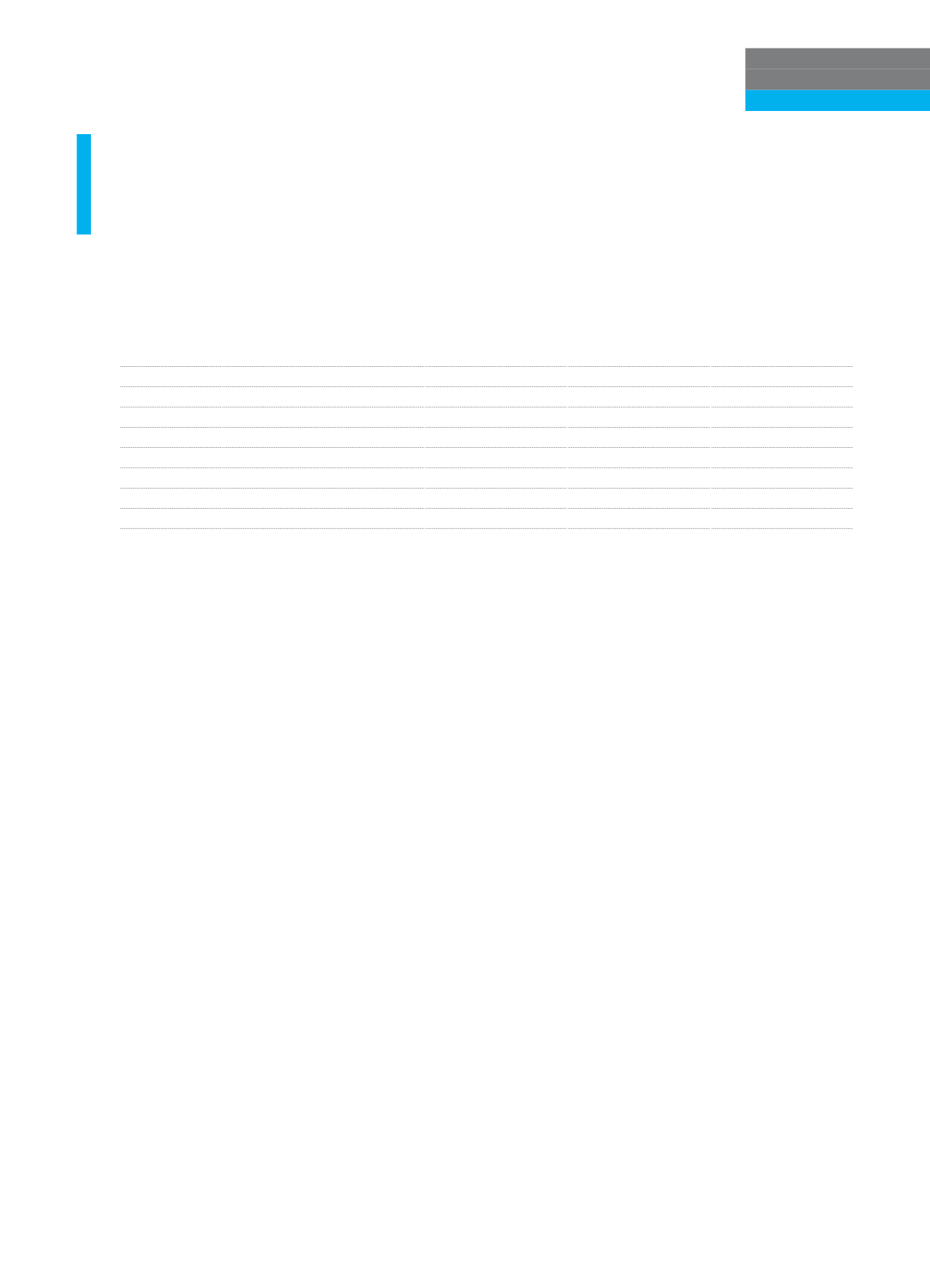

Prior Period

Currency

Applied Shock

(+/-x basis point)

Revenue/

Loss

Revenue/

Shareholders’Equity

Loss/Shareholders’

Equity

1

TRY

500

(15,244)

(3.1859)%

(400)

24,528

5.1263%

2

EURO

200

9,143

1.9108%

(200)

(36,706)

(7.6713)%

3

USD

200

14,158

2.9590%

(200)

25

0.0051%

Total (For negative shocks)

(12,153)

(2.54)%

Total (For positive shocks)

8,057

1.68%

VII. INFORMATION ON STOCK POSITION RISK

Equity investment risk due from banking book

The Bank does not have equity investment risk due to subsidiary and securities issued capital which classified banking accounts are

not traded on the stock exchange.

Information on booking value, fair value and market value of equity investments

None.

Information on equity investments realized gains or losses, revaluation increases and unrealized gains or losses and these

amounts including capital contribution

None.

VIII. INFORMATION ON LIQUIDITY RISK

Source of Bank’s current liquidity risk and whether the related precautions are taken to eliminate the risk, Restrictions

on fund sources established by the board of directors for the purpose of meeting urgent liquidity demand and making

payments for matured debts

The Bank’s liquidity risk has been analyzed within the context of risk management operations. Within this context Bank’s liquidity

risk has been analyzed by common ratio analysis and liquidity position analysis based on payment terms. The periodic reporting

requirement to BRSA is being performed in accordance with the regulation regarding liquidity adequacy measurement.

Whether the payments, assets and liabilities match with the interest rates, and whether the effect of mismatch on

profitability is measured

The main reason of liquidity risk is the existence of long term assets versus short term funds borrowed from abroad. On the other hand,

these short term funds have the capability of being renewed. Bank has strong fund sources besides there is no restriction on fund

sources for the purpose of meeting urgent liquidity demand and making payments for matured debts. As a result of this, the Bank has

not been encountered with liquidity problems and there is no expectation of possible liquidity risk for the future for the Bank.