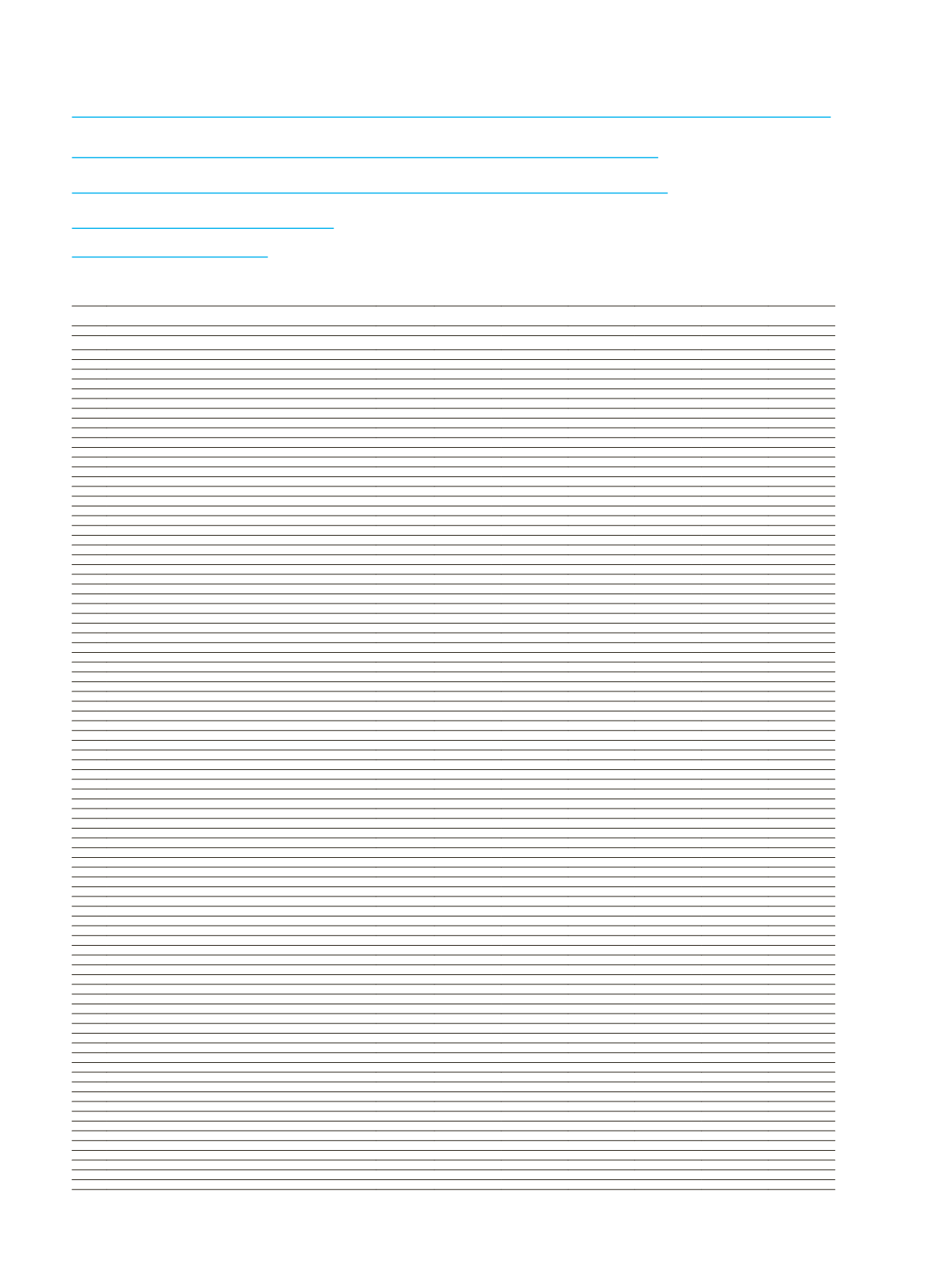

174 A&T BANK ANNUAL REPORT 2015

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

STATEMENT OF CONSOLIDATED OFF BALANCE SHEET ITEMS

AS OF 31 DECEMBER 2015

(THOUSANDS OF TURKISH LIRA)

Audited

Audited

Footnotes

CURRENT PERIOD

(31/12/2015)

PRIOR PERIOD

(31/12/2014)

(5-III)

TL

FC

Total

TL

FC

Total

A. OFF BALANCE SHEET COMMITMENTS (I+II+III)

248.793

2.266.100

2.514.893

256.681

2.233.673

2.490.354

I.

GUARANTEES AND WARRANTIES

(1),(2),(3),(4)

195.367

2.167.043

2.362.410

176.352

2.078.011

2.254.363

1.1.

Letters of guarantee

193.117

1.681.746

1.874.863

176.190

1.519.476

1.695.666

1.1.1.

Guarantees subject to State Tender Law

4.559

166

4.725

4.500

132

4.632

1.1.2.

Guarantees given for foreign trade operations

49.905

1.471.161

1.521.066

22.507

1.326.216

1.348.723

1.1.3.

Other letters of guarantee

138.653

210.419

349.072

149.183

193.128

342.311

1,2 Bank acceptances

-

-

-

-

1.460

1.460

1.2.1.

Import letter of acceptance

-

-

-

-

-

-

1.2.2.

Other bank acceptances

-

-

-

-

1.460

1.460

1.3.

Letters of credit

-

283.579

283.579

-

404.791

404.791

1.3.1.

Documentary letters of credit

-

-

-

-

-

-

1.3.2.

Other letters of credit

-

283.579

283.579

-

404.791

404.791

1.4.

Prefinancing given as guarantee

-

-

-

-

-

-

1.5.

Endorsements

-

-

-

-

-

-

1.5.1.

Endorsements to the Central Bank of Turkey

-

-

-

-

-

-

1.5.2.

Other endorsements

-

-

-

-

-

-

1.6.

Securities issue purchase guarantees

-

-

-

-

-

-

1.7.

Factoring guarantees

-

-

-

-

-

-

1.8.

Other guarantees

2.250

201.718

203.968

162

152.284

152.446

1.9.

Other warrantees

-

-

-

-

-

-

II.

COMMITMENTS

(1)

8.785

55.443

64.228

6.897

82.012

88.909

2.1.

Irrevocable commitments

6.394

48.385

54.779

6.897

82.012

88.909

2.1.1.

Asset purchase and sales commitments

-

-

-

233

5.273

5.506

2.1.2.

Deposit purchase and sales commitments

-

44.964

44.964

-

67.248

67.248

2.1.3.

Share capital commitment to associates and subsidiaries

-

-

-

-

-

-

2.1.4.

Loan granting commitments

3.265

-

3.265

3.589

-

3.589

2.1.5.

Securities issue brokerage commitments

-

-

-

-

-

-

2.1.6.

Commitments for reserve deposit requirements

-

-

-

-

-

-

2.1.7.

Payment commitments for checks

3.129

-

3.129

3.075

-

3.075

2.1.8.

Tax and fund liabilities from export commitments

-

-

-

-

-

-

2.1.9.

Commitments for credit card expenditure limits

-

-

-

-

-

-

2.1.10. Commitments for credit cards and banking services promotions

-

-

-

-

-

-

2.1.11. Receivables from short sale commitments

-

-

-

-

-

-

2.1.12. Payables for short sale commitments

-

-

-

-

-

-

2.1.13. Other irrevocable commitments

-

3.421

3.421

-

9.491

9.491

2.2.

Revocable commitments

2.391

7.058

9.449

-

-

-

2.2.1.

Revocable loan granting commitments

-

-

-

-

-

-

2.2.2.

Other revocable commitments

2.391

7.058

9.449

-

-

-

III.

DERIVATIVE FINANCIAL INSTRUMENTS

(5)

44.641

43.614

88.255

73.432

73.650

147.082

3.1 Derivative financial instruments held for hedging

-

-

-

-

-

-

3.1.1 Fair value hedges

-

-

-

-

-

-

3.1.2 Cash flow hedges

-

-

-

-

-

-

3.1.3 Hedges for investments made in foreign countries

-

-

-

-

-

-

3.2 Trading transactions

44.641

43.614

88.255

73.432

73.650

147.082

3.2.1 Forward foreign currency buy/sell transactions

-

-

-

-

-

-

3.2.1.1 Forward foreign currency transactions-buy

-

-

-

-

-

-

3.2.1.2 Forward foreign currency transactions-sell

-

-

-

-

-

-

3.2.2 Swap transactions related to foreign currency and interest rates

44.641

43.614

88.255

73.432

73.650

147.082

3.2.2.1 Foreign currency swap-buy

-

43.614

43.614

-

73.650

73.650

3.2.2.2 Foreign currency swap-sell

44.641

-

44.641

73.432

-

73.432

3.2.2.3 Interest rate swaps-buy

-

-

-

-

-

-

3.2.2.4 Interest rate swaps-sell

-

-

-

-

-

-

3.2.3 Foreign currency, interest rate and security options

-

-

-

-

-

-

3.2.3.1 Foreign currency options-buy

-

-

-

-

-

-

3.2.3.2 Foreign currency options-sell

-

-

-

-

-

-

3.2.3.3 Interest rate options-buy

-

-

-

-

-

-

3.2.3.4 Interest rate options-sell

-

-

-

-

-

-

3.2.3.5 Securities options-buy

-

-

-

-

-

-

3.2.3.6 Securities options-sell

-

-

-

-

-

-

3.2.4 Foreign currency futures

-

-

-

-

-

-

3.2.4.1 Foreign currency futures-buy

-

-

-

-

-

-

3.2.4.2 Foreign currency futures-sell

-

-

-

-

-

-

3.2.5 Interest rate futures

-

-

-

-

-

-

3.2.5.1 Interest rate futures-buy

-

-

-

-

-

-

3.2.5.2 Interest rate futures-sell

-

-

-

-

-

-

3.2.6 Other

-

-

-

-

-

-

B.

CUSTODY AND PLEDGED SECURITIES (IV+V+VI)

1.102.042

3.637.094

4.739.136

329.363

306.143

635.506

IV.

ITEMS HELD IN CUSTODY

235.769

8.639

244.408

237.969

22.170

260.139

4.1.

Assets under management

-

-

-

-

-

-

4.2.

Investment securities held in custody

-

-

-

-

-

-

4.3.

Checks received for collection

234.582

7.050

241.632

236.534

18.793

255.327

4.4.

Commercial notes received for collection

437

1.589

2.026

685

1.410

2.095

4.5.

Other assets received for collection

-

-

-

-

-

-

4.6.

Assets received for public offering

-

-

-

-

-

-

4.7.

Other items under custody

750

-

750

750

1.967

2.717

4.8.

Custodians

-

-

-

-

-

-

V.

PLEDGED ITEMS

866.273

3.628.455

4.494.728

91.394

283.973

375.367

5.1.

Marketable securities

-

-

-

-

-

-

5.2.

Guarantee notes

86.735

124.787

211.522

69.779

140.141

209.920

5.3.

Commodity

-

-

-

-

-

-

5.4.

Warranty

-

-

-

-

-

-

5.5.

Immovables

12.097

176.957

189.054

21.587

141.128

162.715

5.6.

Other pledged items

767.441

3.326.711

4.094.152

28

2.704

2.732

5.7.

Pledged items-depository

-

-

-

-

-

-

VI.

ACCEPTED INDEPENDENT GUARANTEES AND WARRANTEES

-

-

-

-

-

-

TOTAL OFF BALANCE SHEET COMMITMENTS (A+B)

1.350.835

5.903.194

7.254.029

586.044

2.539.816

3.125.860

The accompanying notes are an integral part of these unconsolidated financial statements.