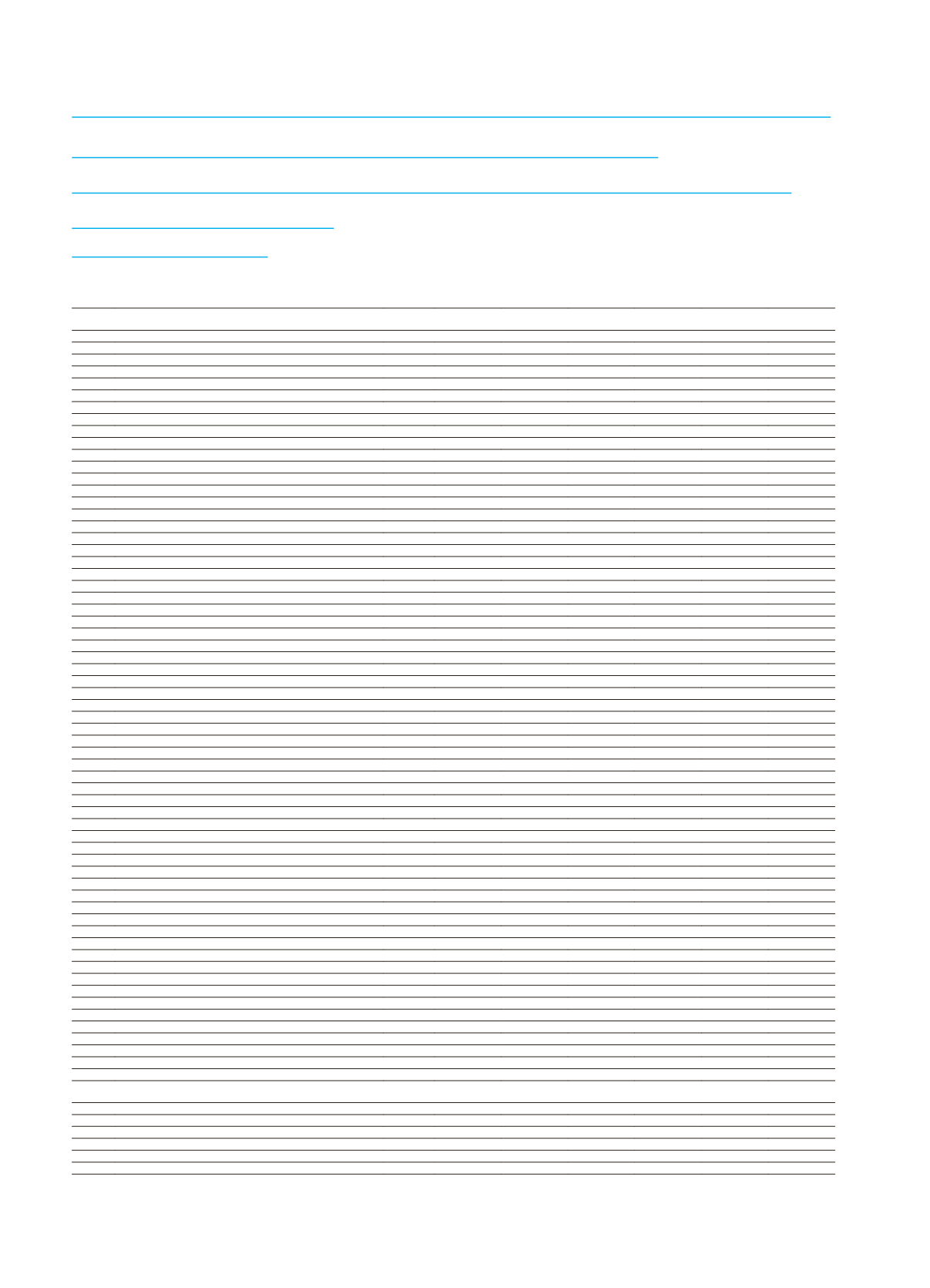

172 A&T BANK ANNUAL REPORT 2015

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONIM ŞIRKETI

CONSOLIDATED BALANCE SHEET (STATEMENT OF FINANCIAL POSITION)

AS OF 31 DECEMBER 2015

(THOUSANDS OF TURKISH LIRA)

Audited

Audited

ASSETS

Footnotes

CURRENT PERIOD

(31/12/2015)

PRIOR PERIOD

(31/12/2014)

(5-I)

TL

FC

Total

TL

FC

Total

I.

CASH AND BALANCES WITH THE CENTRAL BANK OF TURKEY

(1)

8.454

849.701

858.155

6.564

347.676

354.240

II.

FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

(2)

14.220

194.122

208.342

43.716

119.715

163.431

2.1

Financial assets held for trading

14.220

194.122

208.342

43.716

119.715

163.431

2.1.1 Public sector debt securities

14.220

101.821

116.041

33.001

24.018

57.019

2.1.2 Securities representing a share in capital

-

-

-

-

-

-

2.1.3 Derivatives held for trading

-

-

-

782

-

782

2.1.4 Other marketable securities

-

92.301

92.301

9.933

95.697

105.630

2.2

Financial assets designated at fair value through profit or loss

-

-

-

-

-

-

2.2.1 Public sector debt securities

-

-

-

-

-

-

2.2.2 Equity securities

-

-

-

-

-

-

2.2.3 Loans granted

-

-

-

-

-

-

2.2.4 Other marketable securities

-

-

-

-

-

-

III.

BANKS

(3)

26.924

1.220.983

1.247.907

15.378

1.571.948

1.587.326

IV.

MONEY MARKET PLACEMENTS

-

-

-

26.908

-

26.908

4.1

Interbank money market placements

-

-

-

-

-

-

4.2

Istanbul Stock Exchange money market placements

-

-

-

-

-

-

4.3

Receivables from reverse repurchase agreements

-

-

-

26.908

-

26.908

V.

FINANCIAL ASSETS AVAILABLE FOR SALE (Net)

(4)

224

1.164

1.388

224

935

1.159

5.1

Securities representing a share in capital

224

1.164

1.388

224

935

1.159

5.2

Public sector debt securities

-

-

-

-

-

-

5.3

Other marketable securities

-

-

-

-

-

-

VI.

LOANS

(5)

767.109

590.794

1.357.903

663.412

700.886

1.364.298

6.1

Loans

765.166

590.794

1.355.960

661.534

700.886

1.362.420

6.1.1 Loans granted to the Bank's risk group

-

89.650

89.650

-

36.570

36.570

6.1.2 Public sector debt securities

-

-

-

-

-

-

6.1.3 Other

765.166

501.144

1.266.310

661.534

664.316

1.325.850

6.2

Loans under follow-up

13.211

-

13.211

15.092

-

15.092

6.3

Specific provisions (-)

11.268

-

11.268

13.214

-

13.214

VII.

FACTORING RECEIVABLES

-

-

-

-

-

-

VIII.

INVESTMENTS HELD TO MATURITY (Net)

(6)

17.604

263.954

281.558

24.503

117.174

141.677

8.1

Public sector debt securities

1.038

231.020

232.058

24.503

91.232

115.735

8.2

Other marketable securities

16.566

32.934

49.500

-

25.942

25.942

IX.

INVESTMENTS IN ASSOCIATES (Net)

(7)

-

-

-

-

-

-

9.1

Consolidated by equity method

-

-

-

-

-

-

9.2

Unconsolidated associates

-

-

-

-

-

-

9.2.1 Financial investments in associates

-

-

-

-

-

-

9.2.2 Non-financial investments in associates

-

-

-

-

-

-

X.

INVESTMENTS IN SUBSIDIARIES (Net)

(8)

-

-

-

-

-

-

10.1

Financial subsidiaries

-

-

-

-

-

-

10.2

Non-financial subsidiaries

-

-

-

-

-

-

XI.

INVESTMENTS IN JOINT- VENTURES (Net)

(9)

-

-

-

-

-

-

11.1

Consolidated by equity method

-

-

-

-

-

-

11.2

Unconsolidated joint ventures

-

-

-

-

-

-

11.2.1 Financial investments in joint ventures

-

-

-

-

-

-

11.2.2 Non-financial investments in joint ventures

-

-

-

-

-

-

XII.

LEASE RECEIVABLES (Net)

(10)

57.258

190.334

247.592

54.880

163.063

217.943

12.1

Finance lease receivables

68.610

208.832

277.442

67.294

180.921

248.215

12.2

Operational leasing receivables

-

-

-

-

-

-

12.3

Others

-

-

-

-

-

-

12.4

Unearned income ( - )

11.352

18.498

29.850

12.414

17.858

30.272

XIII.

DERIVATIVE FINANCIAL ASSETS HELD FOR HEDGING

(11)

-

-

-

-

-

-

13.1

Fair value hedges

-

-

-

-

-

-

13.2

Cash flow hedges

-

-

-

-

-

-

13.3

Hedges for investments made in foreign countries

-

-

-

-

-

-

XIV.

TANGIBLE ASSETS (Net)

(13)

23.555

-

23.555

25.097

-

25.097

XV.

INTANGIBLE ASSETS (Net)

(14)

2.986

-

2.986

3.179

-

3.179

15.1

Goodwill

-

-

-

-

-

-

15.2

Other

2.986

-

2.986

3.179

-

3.179

XVI.

INVESTMENT PROPERTY (Net)

(12)

-

-

-

-

-

-

XVII.

TAX ASSET

(15)

2.940

-

2.940

2.101

-

2.101

17.1

Current tax asset

-

-

-

-

-

-

17.2

Deferred tax asset

2.940

-

2.940

2.101

-

2.101

XVIII.

ASSET HELD FOR SALE AND ASSETS OF DISCONTINUED

OPERATIONS (Net)

(16)

9

-

9

10

-

10

18.1

Held for sale purpose

9

-

9

10

-

10

18.2

Held from discontinued operations

-

-

-

-

-

-

XIX.

OTHER ASSETS

(17)

11.376

6.045

17.421

13.861

4.593

18.454

TOTAL ASSETS

932.659

3.317.097

4.249.756

879.833

3.025.990

3.905.823

The accompanying notes are an integral part of these unconsolidated financial statements.