112 A&T BANK ANNUAL REPORT 2015

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO UNCONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

The expected effects of the fluctuations of market interest rates on the Bank’s financial position and cash flows,

the expectations for interest income, and the limits the board of directors has established on daily interest rates

The Board of Directors has determined limits for the amount exposed to market risk/ shareholder’s equity, to be

maximum 45% for the early warning limit, 50% for limit maximum, and maximum 55% for limit exception in order to

follow interest rate risk, exchange rate risk and equity price risk.

The precautions taken for the interest rate risk the Bank was exposed to during the current year and their

expected effects on net income and shareholders’ equity in the future periods

Although the increase in interest rates have a limited negative effect on the Bank’s financial position the Bank’s Equity

structure is able to confront the negative effects of possible fluctuations in the interest rates.

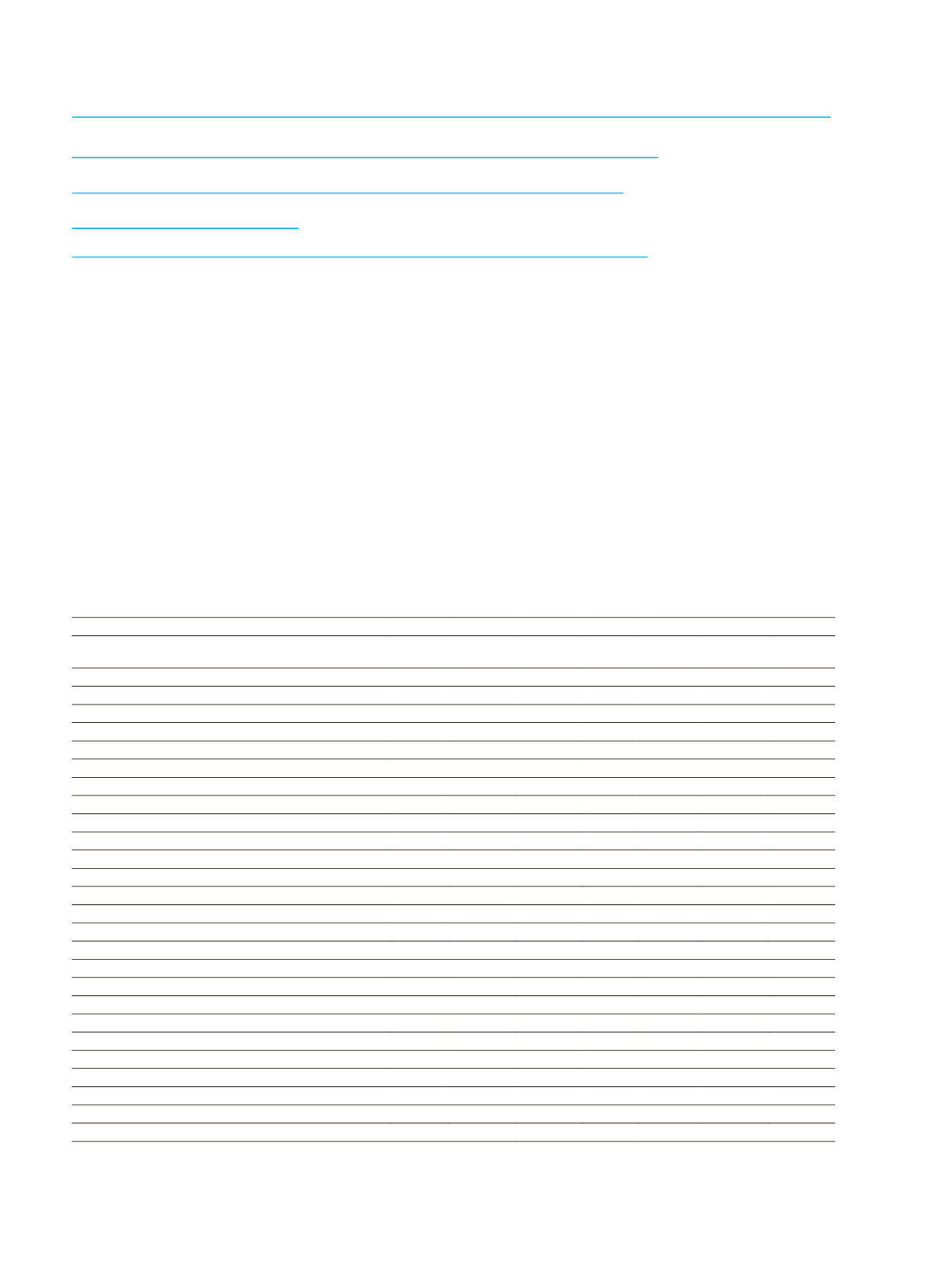

Information related to interest rate sensitivity of assets, liabilities and off-balance sheet items (based on re-

pricing dates)

Current Period

Up to

1 Month

1-3

Months

3-12

Months

1-5

Years

5 Years

and Over

Non-

Interest

Bearing

Total

Assets

Cash (cash in vault, foreign currencies, cash in transit, cheques

purchased) and balances with the Central Bank of Turkey

341,933

-

-

-

-

516,221 858,154

Banks

924,758 281,941

-

-

-

- 1,206,699

Financial assets at fair value through Profit or Loss

14,580 25,567

9,335 158,860

-

-

208,342

Interbank Money Market Placements

-

-

-

-

-

-

-

Financial assets available-for-sale

-

-

-

-

-

1,388

1,388

Loans

804,298 425,213 114,455

554

-

13,383 1,357,903

Investment securities held-to-maturity

1,038 139,634 22,314 104,433 14,139

-

281,558

Other assets

1

-

-

-

-

-

109,248 109,248

Total assets

2,086,607 872,355 146,104 263,847 14,139 640,240 4,023,292

Liabilities

Bank deposits

1,490,139 593,292 755,156

-

-

- 2,838,587

Other deposits

21,323 22,802 35,612

-

-

429,392 509,129

Money market borrowings

3,493

-

-

-

-

-

3,493

Miscellaneous payables

-

-

-

-

-

1,012

1,012

Marketable securities issued

-

-

-

-

-

-

-

Funds Borrowed From Other Fin. Ins.

207

-

3,166

-

-

-

3,373

Other liabilities

2

753

-

-

-

-

666,945 667,698

Total liabilities

1,515,915 616,094 793,934

-

- 1,097,349 4,023,292

Long Position in the Balance Sheet

570,692 256,261

- 263,847 14,139

- 1,104,939

Short Position in the Balance Sheet

-

- (647,830)

-

- (457,109) (1,104,939)

Long Position in the Off-balance Sheet

43,614

-

-

-

-

-

43,614

Short Position in the Off-balance Sheet

(44,641)

-

-

-

-

-

(44,641)

Total Position

569,665 256,261 (647,830) 263,847 14,139 (457,109)

(1,027)

1

Other Assets: The amount of TL 109,248 in the Non-Interest Bearing column is composed of Subsidiaries amounting to TL 70,213, Tangible Assets

amounting to TL 19,611, Intangible Assets amounting to TL 2,648, Deferred Tax Assets amounting to TL 2,830, Assets Held for Sale amounting to

TL 9, Miscellaneous Receivables amounting to TL 1,830, and Other Assets amounting to TL 12,107.

2

Other Liabilities: The amount of TL 666,945 in the Non-Interest Bearing Column is composed of Shareholders’ Equity amounting to TL 601,823,

Provisions amounting to TL 39,645, Tax, Duty and Premium Payable amounting to TL 11,527 and Other Foreign Resources amounting to TL 13,950.