111

FINANCIAL INFORMATION

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO UNCONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

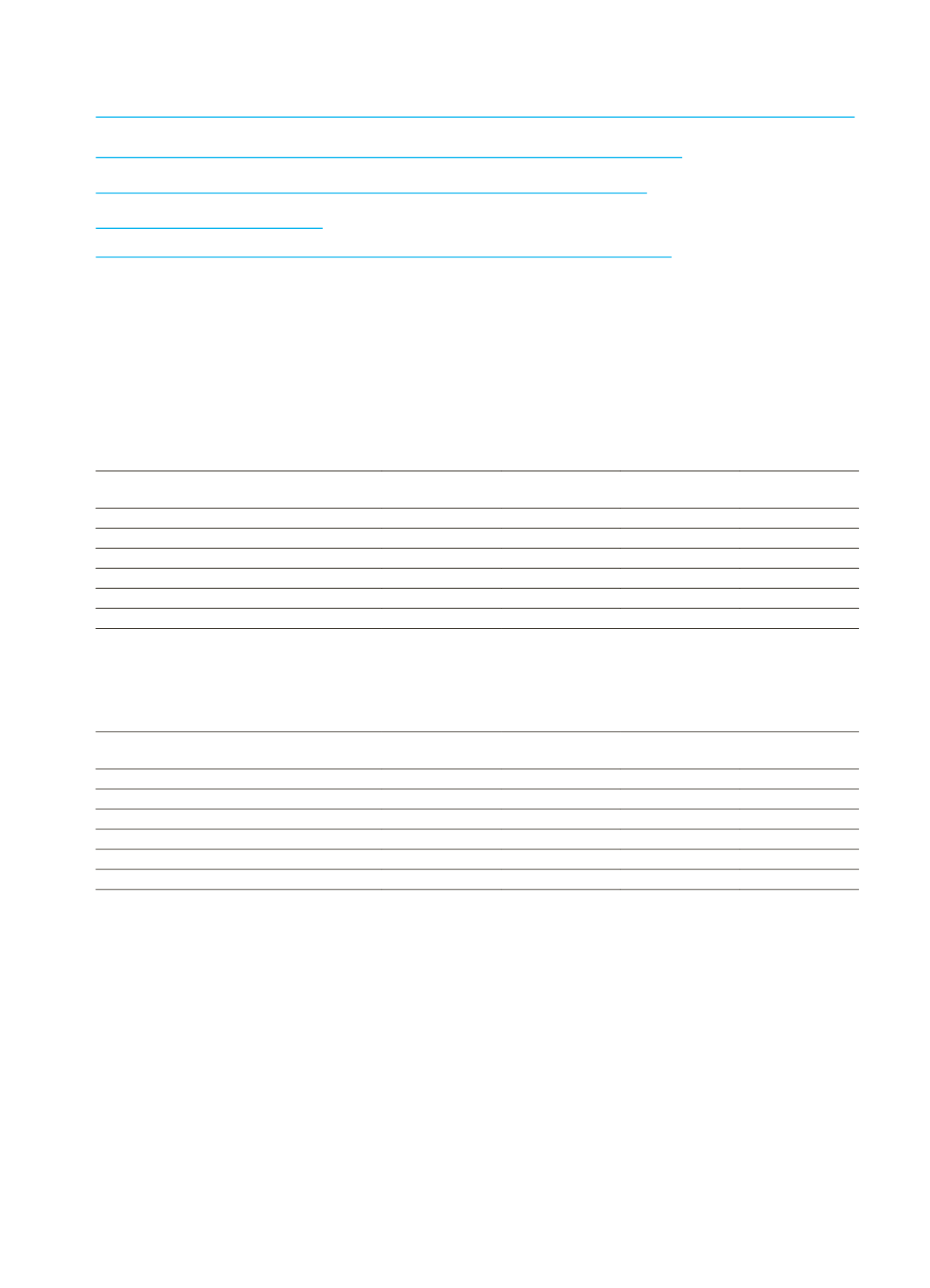

Exposed currency risk

The possible increases or decreases in the shareholders’ equity and the profit/loss as per an assumption of devaluation/

appreciation by 10 percent of TL against currencies mentioned below as of 31 December 2015 and 31 December

2014 are presented in the below table. The other variables, especially the interest rates, are assumed to be fixed in this

analysis.

Assuming 10 percent appreciation of TL;

Current Period

Prior Period

Income

Statement

Shareholders’

Equity

(*)

Income

Statement

Shareholders’

Equity

(*)

Euro

1,776

1,776

(50)

(50)

US Dollar

(834)

(834)

(26)

(26)

Other Currencies

(2,229)

(2,229)

(47)

(47)

Total

(1,287)

(1,287)

(123)

(123)

(*)

The effect on shareholders’ equity also includes the effect on the profit/loss.

Assuming 10 percent depreciation of TL;

Current Period

Prior Period

Income

Statement

Shareholders’

Equity

(*)

Income

Statement

Shareholders’

Equity

(*)

Euro

(1,776)

(1,776)

50

50

US Dollar

834

834

26

26

Other Currencies

2,229

2,229

47

47

Total

1,287

1,287

123

123

(*)

The effect on shareholders’ equity also includes the effect on the profit/loss.

VI. INFORMATION ON INTEREST RATE RISK

Interest rate sensitivity of the assets, liabilities and off-balance sheet items

Within the context of the market risk management of the Risk Management Department, the Bank’s interest rate risk

is calculated and analyzed taking different dimensions of the issue in consideration. The interest rate risk is measured

according to market risk calculated using the standard method and is included in the capital adequacy ratio. To test the

effect of the interest rate fluctuations on the Bank monthly based stress test analysis are done.

In addition, by classifying the changes in risk factors different scenario analysis are done based on different interest rate

expectations. The sensitivity of assets, liabilities and off-balance sheets against interest rate are measured by an analysis

on a monthly basis.