210

A&T BANK 2014 FAALİYET RAPORU

Convenience Translation of Publicly Announced Consolidated Fınancial

Statements Originally Issued in Turkish, See Note I of Section Three

Arap Türk Bankası A.Ş.

Notes to Consolidated Financial

Statements at 31 December 2014

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

ANNU L R PORT 2014

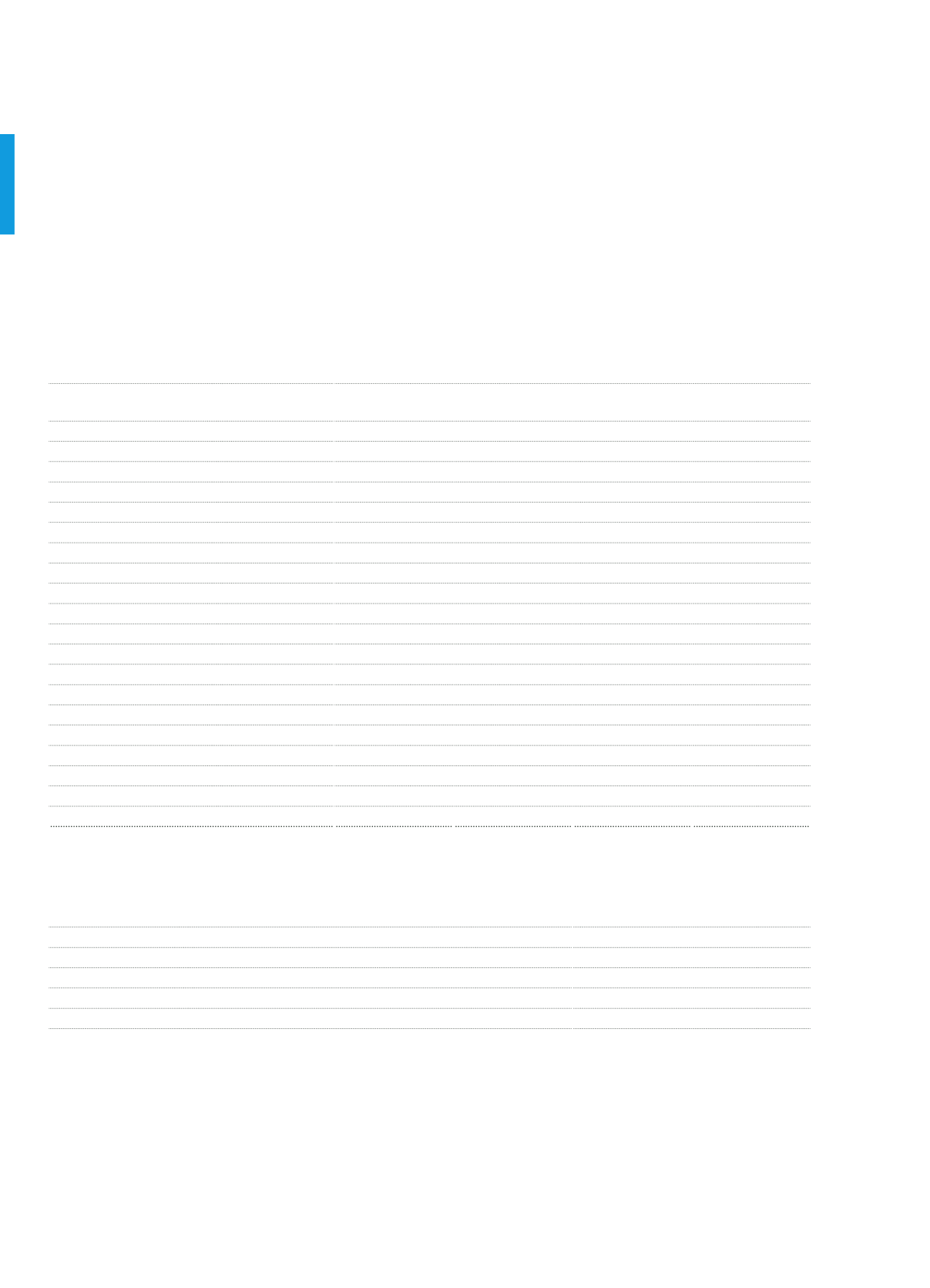

12. Sector or counterparty type, individually impaired loans and non-performing loan amounts, value adjustments and

provisions during the period information on value adjustments and provisions

Miscellaneous information based on important sectors and counterparty type

Loans

Sectors

Impaired Loans

Past Due But

Not Impaired

Value

Adjustment

(*)

Provisions

Agricultural

529

-

1,009

529

Farming and Stockbreeding

529

-

1,004

529

Forestry

-

-

5

-

Fishing

-

-

-

-

Manufacturing

2,484

-

5,459

2,481

Mining

-

-

511

-

Production

2,484

-

4,948

2,481

Electric, gas and water

-

-

-

-

Construction

7,429

-

3,564

5,549

Services

4,650

-

4,903

4,655

Wholesale and retail trade

2,518

-

480

2,523

Hotel, food and beverage services

2,032

-

-

2,032

Transportation and telecommunication

-

-

-

-

Financial institutions

100

-

4,312

100

Real estate and Leasing services

-

-

-

-

“Self-employment” type Services

-

-

-

-

Education services

-

-

-

-

Health and social services

-

-

111

-

Other

-

-

80

-

Total

15,092

-

15,015

13,214

(*)

General Loan Loss provision for cash loans were distributed in value adjustments section.

13. Value adjustments and provisions on the exchange of credit information

Specific Provision General Provision

Opening Balance

8,446

20,411

The amount of provision during the period

4,911

444

Reversal of provision

(143)

(1,171)

Other adjustments

(*)

-

-

Closing Balance

13,214

19,684

(*)

According to set exchange rate differences, business combinations, acquisitions transactions and disposals of subsidiaries.