203

Convenience Translation of Publicly Announced Consolidated Fınancial

Statements Originally Issued in Turkish, See Note I of Section Three

Arap Türk Bankası A.Ş.

Notes to Consolidated Financial

Statements at 31 December 2014

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

General Information

Corporate Management

Financial Information

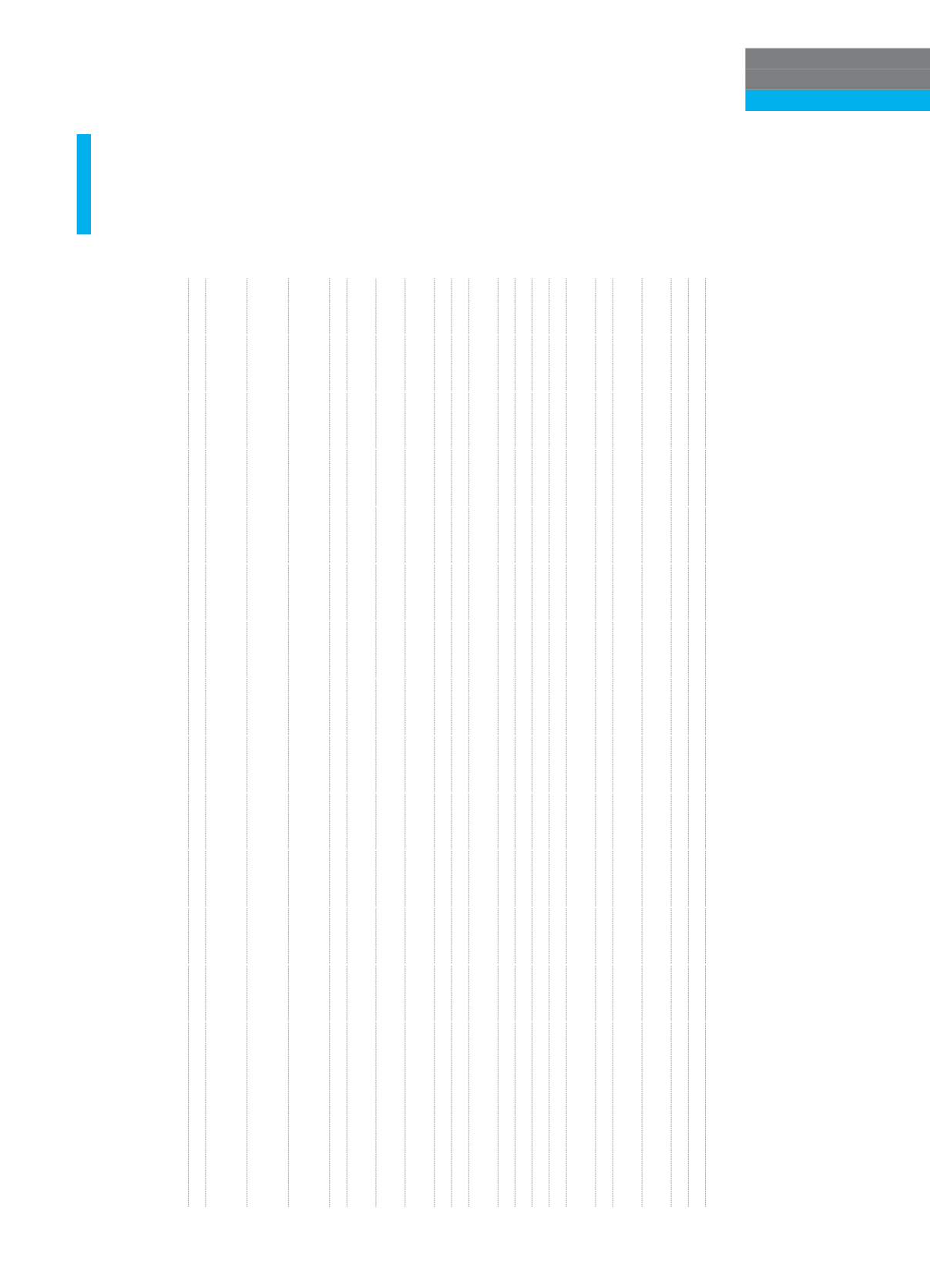

Credit risk is the risk reduction effects without taking into consideration the total amount of exposures after offsetting transactions with the related

risks are differentiated according to the different risk classes and the types of the average amount for the period

2014

Risk Classifications

January February

March

April

May

June

July

August September

October November December

Average

Contingent and Non-Contingent Receivables

from Sovereign Governments and Central

Banks

544,927 552,081 540,416 514,893 464,754 458,145 472,444 451,971 464,507 478,390 471,390 464,333 489,854

Contingent and Non-Contingent Receivables

from Regional Governments and Local

Authorities

-

-

-

-

-

-

-

-

-

-

-

-

-

Contingent and Non-Contingent Receivables

from Administrative Units and Non-

commercial

Enterprises

-

-

-

-

-

-

-

-

-

-

-

-

-

Contingent and Non-Contingent Receivables

fromMultilateral Development Banks

-

-

-

-

-

-

-

-

-

-

-

-

-

Contingent and Non-Contingent Receivables

from International Organizations

-

-

-

-

-

-

-

-

-

-

-

-

-

Contingent and Non-Contingent Receivables

from Banks and Financial Intermediaries

2,684,516 2,706,100 2,592,735 2,213,840 2,239,753 2,374,420 2,114,412 2,236,057 2,492,221 2,278,322 2,314,331 2,700,637 2,412,279

Contingent and Non-Contingent Corporate

Receivables

1,711,043 1,730,259 1,733,820 1,668,966 1,664,296 1,773,668 1,763,452 1,858,373 1,853,004 1,879,003 1,754,847 1,692,706 1,756,953

Contingent and Non-Contingent Retail

Receivables

-

-

-

-

-

-

-

-

-

-

-

-

-

Contingent and Non-Contingent Receivable

Secured by Property

75,903

73,078

65,951

63,637

61,826

62,025

59,643

60,988

63,854

60,537

58,223

56,649

63,526

Past Due Loans

286

282

2,752

2,645

2,641

2,444

2,418

2,278

2,256

2,235

3,928

1,878

2,170

Higher-Risk Receivables Defined by BRSA

469,103 377,390 324,254 328,264 348,057 380,114 334,411 277,705 213,166 171,423 244,850 254,158 310,241

Marketable Securities Collateralized

Mortgages

-

-

-

-

-

-

-

-

-

-

-

-

-

Securitization Exposures

-

-

-

-

-

-

-

-

-

-

-

-

-

Short-Term Receivables from Banks and

Corporate

-

-

-

-

-

-

-

-

-

-

-

-

-

Undertakings for Collective Investments in

Mutual Funds

-

-

-

-

-

-

-

-

-

-

-

-

-

Other Receivables

40,021

39,100

40,380

37,481

39,438

39,368

41,042

37,425

41,859

38,225

37,610

41,632

39,465

Total exposure to risks

5,525,799 5,478,290 5,300,308 4,829,726 4,820,765 5,090,184 4,787,822 4,924,797 5,130,867 4,908,135 4,885,179 5,211,993 5,074,489