159

Convenience Translation of Publicly Announced Unconsolidated Financial

Statements Originally Issued in Turkish, See Note I of Section Three

Arap Türk Bankası A.Ş.

Notes to Unconsolidated Financial

Statements at 31 December 2014

( Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated. )

General Information

Corporate Management

Financial Information

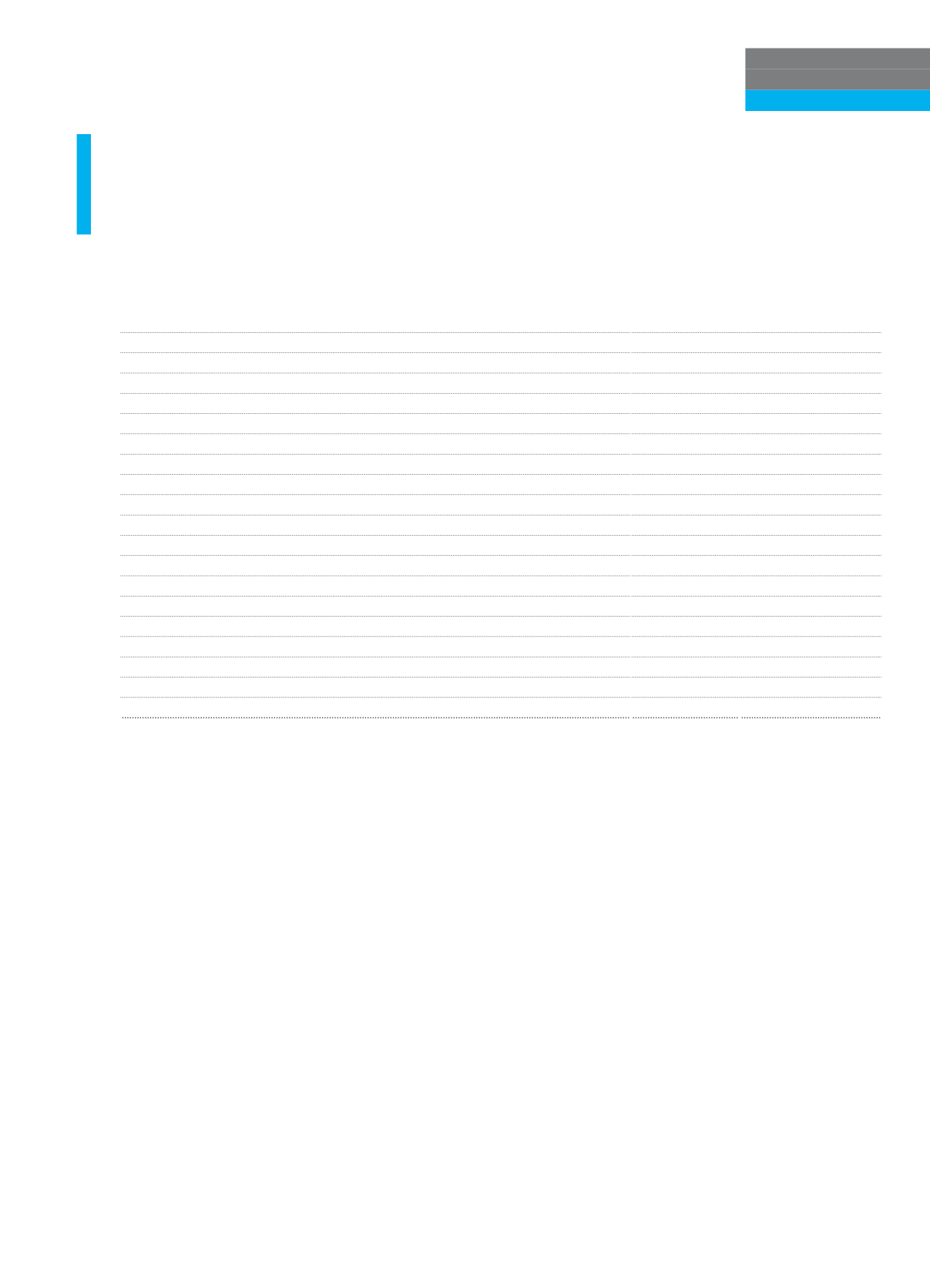

7. Information on other operating expense

Current Period

Prior Period

Personnel Expenses

42,306

36,416

Employee Termination Benefits Expense

690

1,167

Tangible Fixed Asset Impairment Expense

-

-

Amortization Expenses of Tangible Assets

2,779

2,620

Intangible Fixed Asset Impairment Expense

-

-

Goodwill Impairment Expense

-

-

Amortization Expenses of Intangible Assets

1,175

972

Shareholders Equity Procedure Applied Equity Interest Impairment Expense

-

-

Disposable Fixed Asset Impairment Expense

1

1

Amortization Expense of Assets Held for Resale

-

8

Impairment Expense related to Fixed Assets held for sale and discontinued operations

-

-

Other Operating Expenses

10,110

8,166

Operating Lease Expenses

1,440

1,219

Maintenance Expenses

261

168

Advertisement Expenses

568

466

Other Expenses

7,841

6,313

Losses from sales of Assets

3

-

Other

4,901

3,677

Total

61,965

53,027

8. Information on profit/loss before taxes including profit/loss from discontinued operations

The pre-tax income amount from continued operations is TL 89,389 (31 December 2013: TL 61,819).

9. Information on tax provision related to continued operations and discontinued operations

Current period taxation benefit or charge and deferred tax benefit or charge

As of 31 December 2014, taxation charge is TL 18,407 (31 December 2013: TL 12,151) and deferred tax expense is TL 476

(31 December 2013: TL 78 as deferred tax income).

Deferred tax charge/income represented in the income statement within the context of temporary difference, financial loss

and tax reduction

The Bank has TL 476 as deferred tax expense reflected in the income statement computed over temporary difference and tax

deductions and exemptions (31 December 2013: TL 78 deferred tax income).

10. Information on net profit or loss of the period including profit/loss from continued and discontinued operations

Current period profit from continued operations is TL 70,506 (31 December 2013: TL 49,590 profit).

11. Information on net profit or loss of the period

Information on nature, dimension and frequency rate of income and expense accounts resulting from ordinary banking

transactions if they are necessary for explaining the Bank’s current period performance

None.