85

FINANCIAL INFORMATION

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO UNCONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

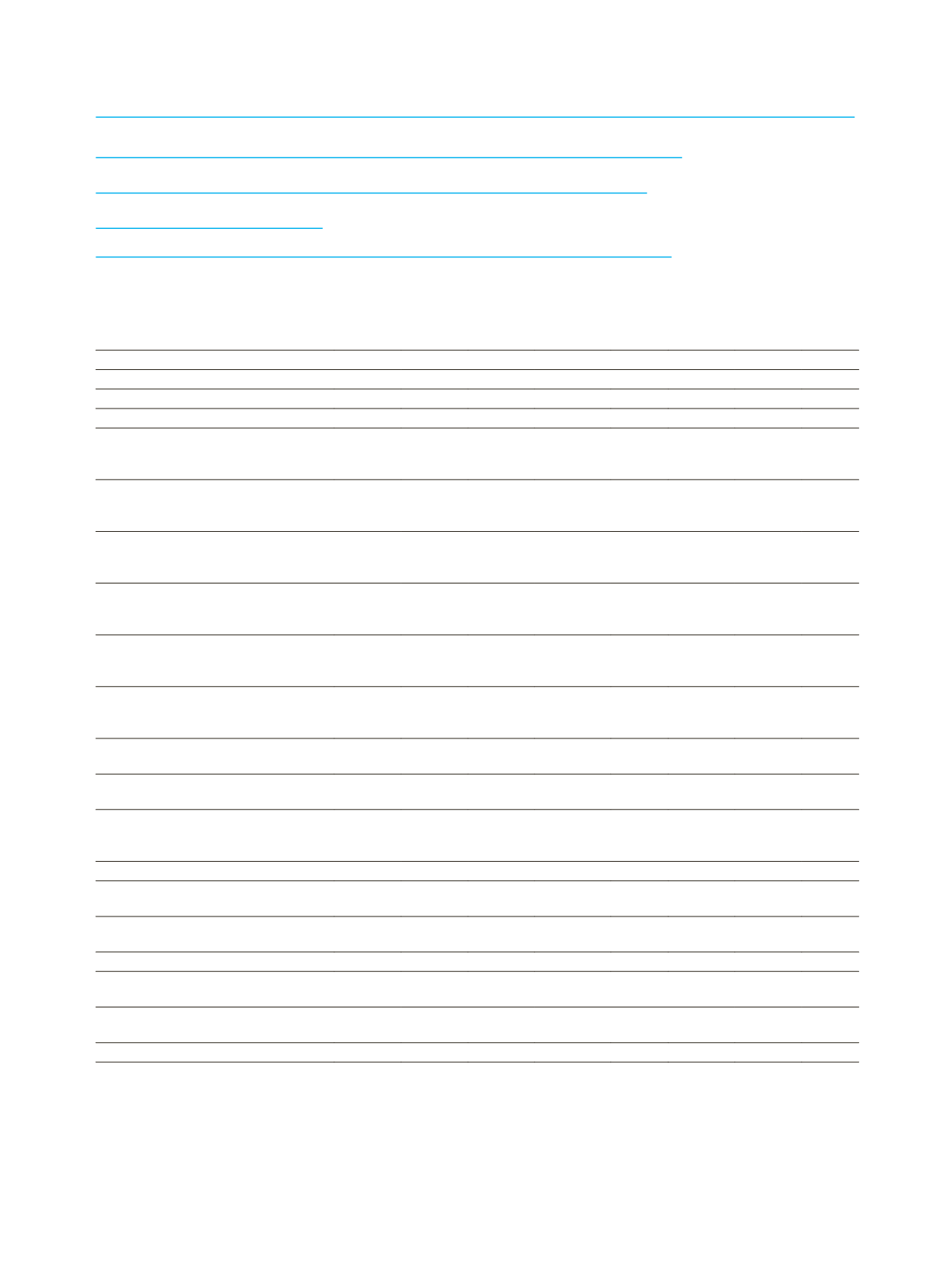

Information on unconsolidated capital adequacy standard ratio

Current Period

Risk Weight

0% 10% 20% 50% 75% 100% 150% 200%

The Amount Subject to Credit Risk

862,023

- 466,996 2,269,238

- 1,519,020 52,011

-

Risk Types

Contingent and Non-Contingent

Receivables from Central Governments

and Central Banks

853,038

-

-

231,018

-

-

-

-

Contingent and Non-Contingent

Receivables from Regional Governments

and Local Authorities

-

-

-

-

-

-

-

-

Contingent and Non-Contingent

Receivables from Administrative Units

and Non-commercial Enterprises

-

-

-

-

-

-

-

-

Contingent and Non-Contingent

Receivables from Multilateral

Development Banks

-

-

-

-

-

-

-

-

Contingent and Non-Contingent

Receivables from International

Organizations

-

-

-

-

-

-

-

-

Contingent and Non-Contingent

Receivables from Banks and Financial

Intermediaries

-

- 466,996 2,009,650

-

40,392

-

-

Contingent and Non-Contingent

Corporate Receivables

-

-

-

-

- 1,369,792

-

-

Contingent and Non-Contingent Retail

Receivables

-

-

-

-

-

-

-

-

Contingent and Non-Contingent

Receivables Secured by Residential

Property

-

-

-

28,570

-

10,602

-

-

Past Due Loans

-

-

-

-

-

1,583

-

-

Higher-Risk Receivables Defined by

BRSA

-

-

-

-

-

-

52,011

-

Marketable Securities Collateralized

Mortgages

-

-

-

-

-

-

-

-

Securitization Exposures

-

-

-

-

-

-

-

-

Short-Term Receivables from Banks and

Corporate

-

-

-

-

-

-

-

-

Undertakings for Collective Investments

in Transferable Securities

-

-

-

-

-

-

-

-

Other Receivables

8,985

-

-

-

-

96,651

-

-