233

FINANCIAL INFORMATION

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

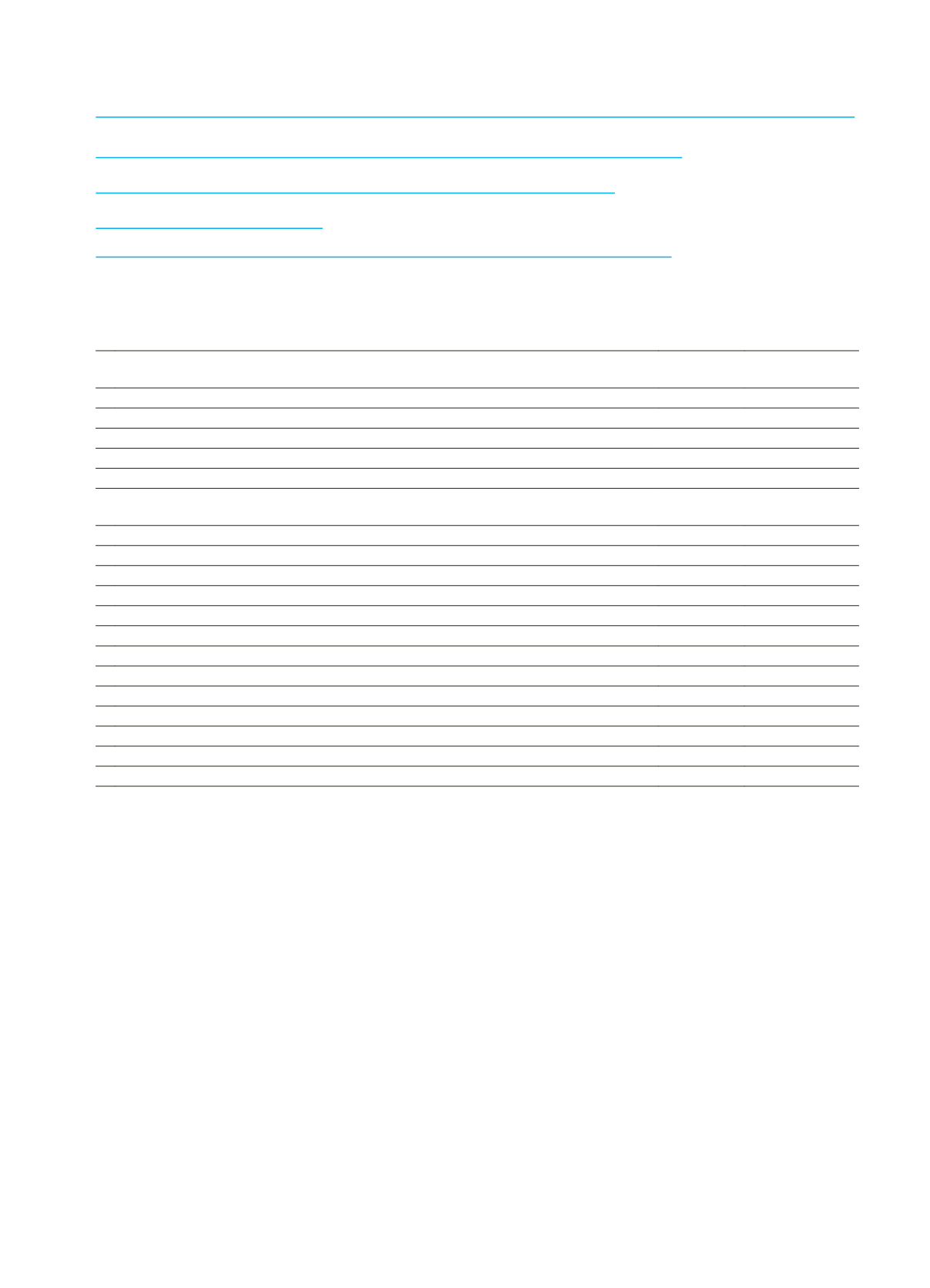

Leverage ratio disclosure as follows:

Balance sheet assets

Prior Period Current Period

1 Balance sheet assets

(Except for derivative financial instruments and credit derivatives, including warranties)

3,638,333

4,210,261

2 (Assets deducted from main capital)

(3,851)

(3,754 )

3 Total risk amount of the balance sheet assets (Sum of 1st and 2nd rows)

3,634,482

4,206,507

Derivative financial instruments and credit derivatives

4 Replacement cost of derivative financial instruments and credit derivatives

-

-

5 Potential credit risk amount of derivative financial instruments and credit derivatives

831

463

6 Total risk amount of derivative financial instruments and credit derivatives

(Sum of 4th and 5th rows)

831

463

Security or secured financing transactions

7 Risk amount of security or secured financing transactions (Except balance sheet)

480

-

8 Risk amount due to intermediated transactions

-

-

9 Total risk amount of security or secured financing transactions (Sum of 7th and 8th rows)

480

-

Off-balance sheet transactions

10 Gross nominal amount of off-balance sheet transactions

2,321,080

2,451,795

11 (Adjustment amount resulting from multiplying by credit conversion rates)

-

-

12 Risk amount of the off-balance sheet transactions (Sum of 10th and 11th rows)

2,321,080

2,451,795

Equity and total risk

13 Main capital

542,306

608,429

14 Total risk amount (Sum of 3th, 6th, 9th and 12th rows)

5,956,874

6,658,764

Leverage ratio

15 Leverage ratio

9.11%

9.14%

(*)

Amounts in the table are obtained on the basis of three-month weighted average.

IX. INFORMATION ON FAIR VALUES OF FINANCIAL ASSETS AND LIABILITIES

The fair value of the held to maturity financial assets; in case of situations where market price or fair value cannot be

determined; is calculated over the quoted market prices of other investment securities that are of the same interest,

maturity and similar in other clauses.

The estimated fair value of the demand deposit represents the amount to be paid at the moment of demand.

Placements of changing rates and the fair value of the overnight deposit equal to their book values. The fair value of

the fixed yield deposit is calculated over the cash flows discounted using the market interest rates implicated on similar

borrowing and other payables.

The estimated fair value of the loans is calculated over the cash flows discounted using the market interest rates

implicated on the constant interest loans. The carrying values of floating-rate loans are deemed a reasonable proxy for

their fair values.