223

FINANCIAL INFORMATION

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

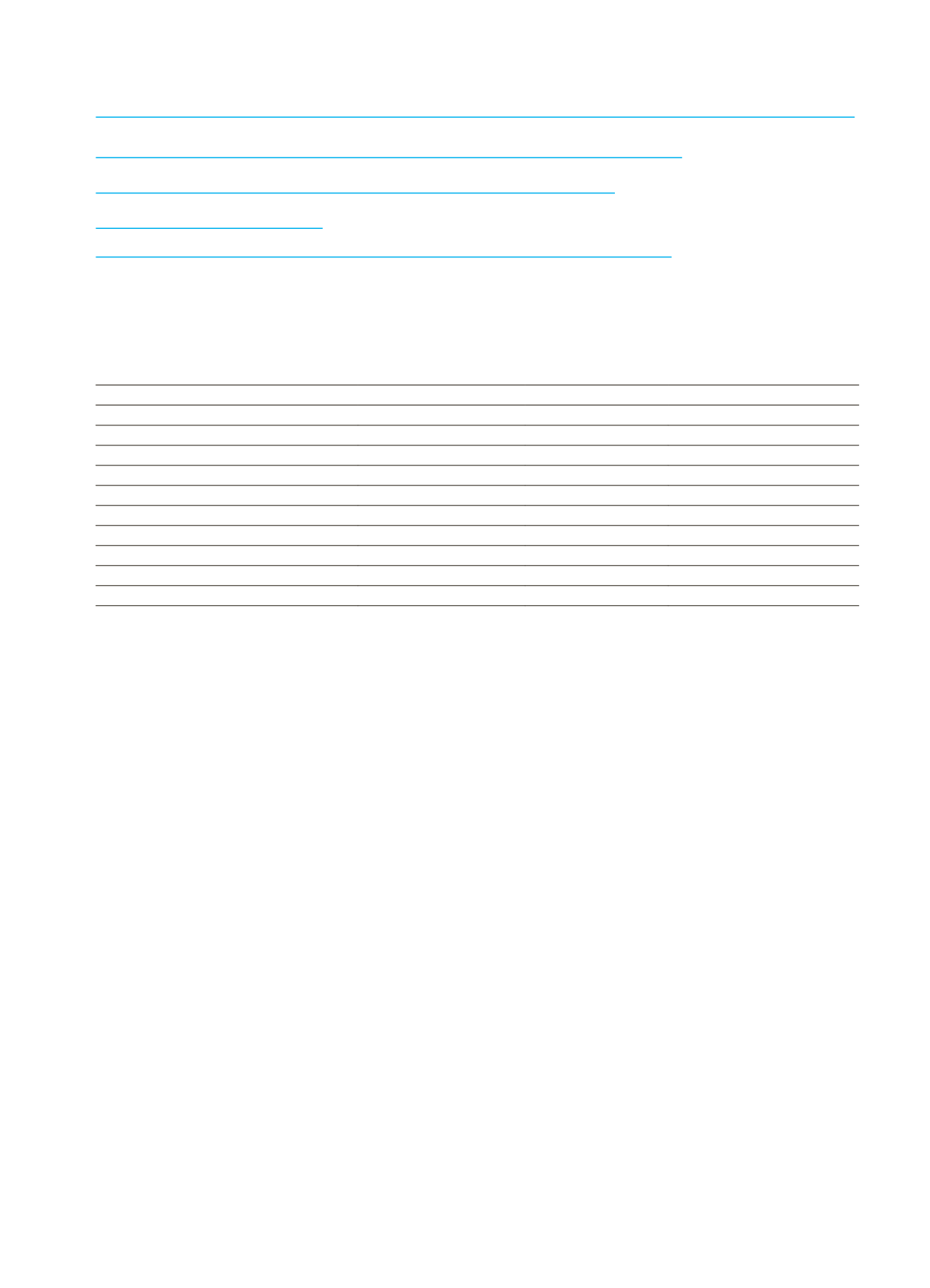

Prior Period

Currency

Applied Shock

(+/- x basis point)

Revenue Loss/

Revenue/Shareholders

‘Equity

Loss/ Shareholders’ Equity

TRY

500

(19,833)

(3.56)%

(400)

34,207

6.14%

EURO

200

36,506

6.55%

(200)

342,112

61.42%

USD

200

42,562

7.64%

(200)

(333,307)

(59.84)%

Total (For negative shocks)

43,012

7.72%

Total (For positive shocks)

59,235

10.63%

VII. INFORMATION ON STOCK POSITION RISK

Equity investment risk due from banking book

The Parent Bank does not have equity investment risk due to subsidiary and securities issued capital which classified

banking accounts are not traded on the stock exchange.

Information on booking value, fair value and market value of equity investments

None.

Information on equity investments realized gains or losses, revaluation increases and unrealized gains or losses

and these amounts including capital contribution

None.

VIII. CONSOLIDATED LIQUIDITY RISK MANAGEMENT AND LIQUIDITY COVERAGE RATIO

Information on liquidity risk management regarding risk capacity of the Parent Bank, responsibilities and

structure of the liquidity risk management, reporting of the liquidity risk in the Parent Bank, the way that sharing

liquidity risk strategy, policy and implementations with the board of directors and job fields

Evaluation of capacity of liquidity risk position of the Parent Bank depends on current liquidity position, current and

estimated asset quality, current and future income capacity, historical funding needs, estimated funding needs and

decreasing funding needs or analysis of decrease in additional funding choices. One or more actions below are done to

find funds in order to maintain liquidity needs.

- Disposal of the liquid assets

- Maintain increasing short term debts and/or additional short term time deposit and deposit like assets

- Decrease in moveable long term assets

- Increase in long term liabilities

- Increase in equity funds