196 A&T BANK ANNUAL REPORT 2015

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

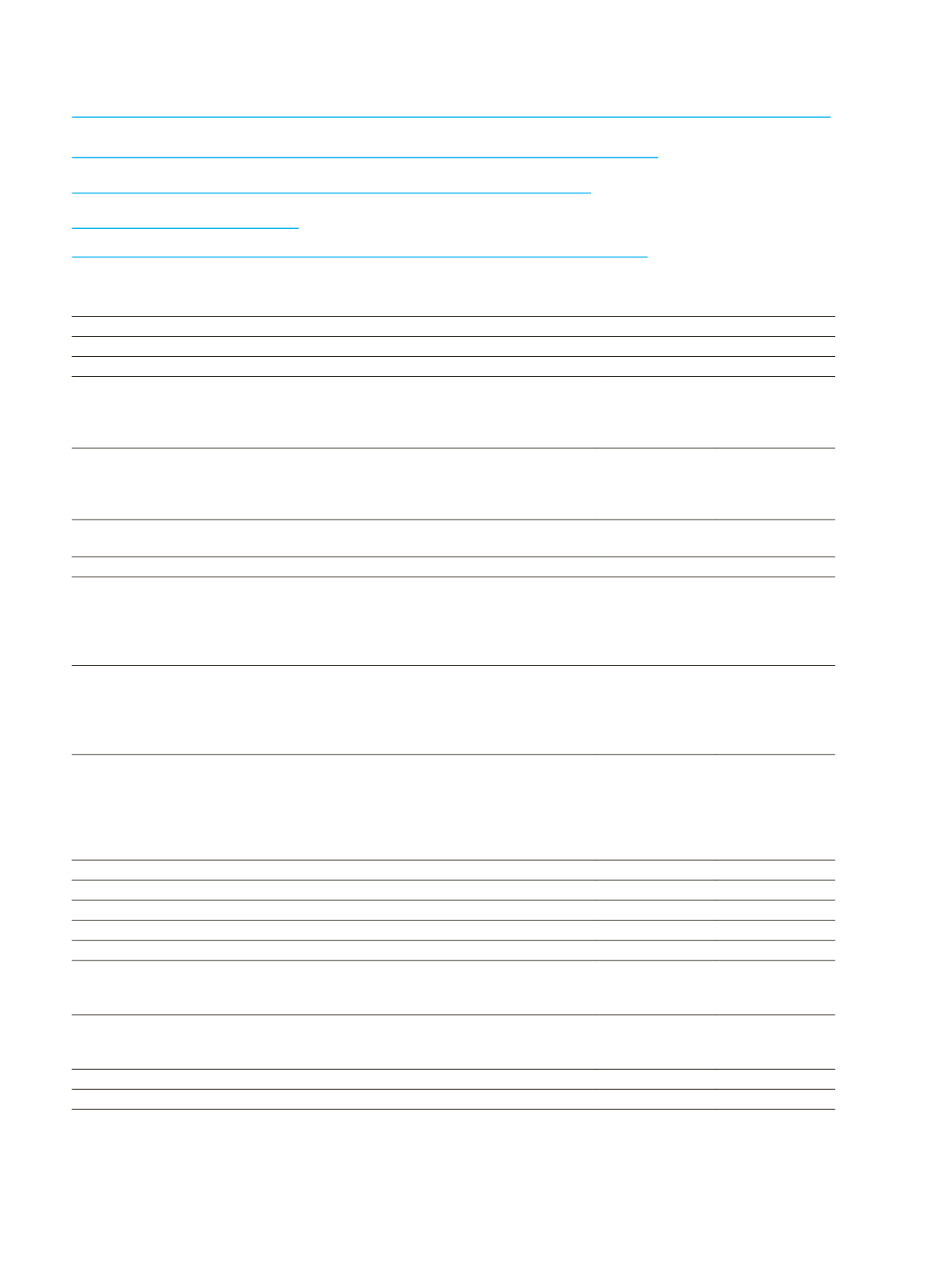

Current Period Prior Period

CAPITAL

638,707

566,174

Loans extended being noncompliant with articles 50 and 51 of the Law (-)

-

-

Net book values of properties owned, exceeding 50% of banks’ equity and

properties, and trade goods overtaken in exchange for loans and receivables that

should be disposed within five years in accordance with article 57 of the Law, but

not yet disposed (-)

9

10

Investments to loans extended to banks, financial institutions (domestic and

abroad) and qualified shareholders, like secondary subordinated loan and debt

instruments purchased from these institutions issued, like primary and secondary

subordinated loan (-)

-

-

Deduction from equity in accordance with 2nd article of 20th item in Regularity of

Measurement and Valuation of Capital Adequacy of Banks (-)

-

-

Other accounts determined by board (-)

-

-

Non deducted part of Common Tier 1capital, additional core and supplementary

capital in accordance with temporary article 2/1 of Regulation of Shareholders’’

Equity of Banks which is 10% exceed part of Common Tier 1capital of bank

from the sum of partnership share on banks and financial institutions that are not

consolidated, with a shareholding less than 10% (-)

-

-

Non deducted part of Common Tier 1capital, additional core and supplementary

capital in accordance with temporary article 2/1 of Regulation of Shareholders’’

Equity of Banks which is 10% exceed part of Common Tier 1capital of bank

from the sum of partnership share on banks and financial institutions that are not

consolidated, with a shareholding of 10% or above (-)

-

-

Non deducted part of Common Tier 1capital generating from exceed amount

generating from investments to Common Tier 1capital of partnership share on

banks and financial institutions that are not consolidated, with a shareholding of

10% and above, temporary differences of deferred tax income and the right of

offering mortgage services explained in the 1st and 2nd paragraphs of temporary

article 2 of Regulation of Shareholders’ Equity of Banks. (-)

-

-

SHAREHOLDERS’ EQUITY

638,698

566,164

Amounts Below Overrun Amounts In Applied Reducing Procedures

-

-

Amount generating from long position of investments to shareholders’ equity and

partnership share on banks and financial institutions that are not consolidated,

with a shareholding less than 10%

-

-

Amount generating from long position of investments to shareholders’ equity and

partnership share on banks and financial institutions that are not consolidated,

with a shareholding of 10% or above.

-

-

Amount generating from right of offering mortgage service

-

-

Amount generating from temporary differences of deferred income tax income

-

-

(*)

The amount contains TL (2,268) actuarial loss/gain amount that accounted under “Other Reserves” according to TAS 19 (31 December 2014:

(1,791) TL).