159

FINANCIAL INFORMATION

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO UNCONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

10. Information on net profit or loss of the period including profit/loss from continued and discontinued

operations

Current period profit from continued operations is TL 70,106 (31 December 2014: TL 70,506).

11. Information on net profit or loss of the period

Information on nature, dimension and frequency rate of income and expense accounts resulting from ordinary banking

transactions if they are necessary for explaining the Bank’s current period performance

None.

Information on the profit or loss effect of a change in an estimation related to financial statements and future period

effect of the change in this estimation

There is no change in accounting estimation related to consolidated financial statements.

Profit/loss regarding minority rights

There is no profit/loss regarding minority rights in the accompanying unconsolidated financial statements since the

Parent Bank owns 99.98% of the consolidated subsidiary

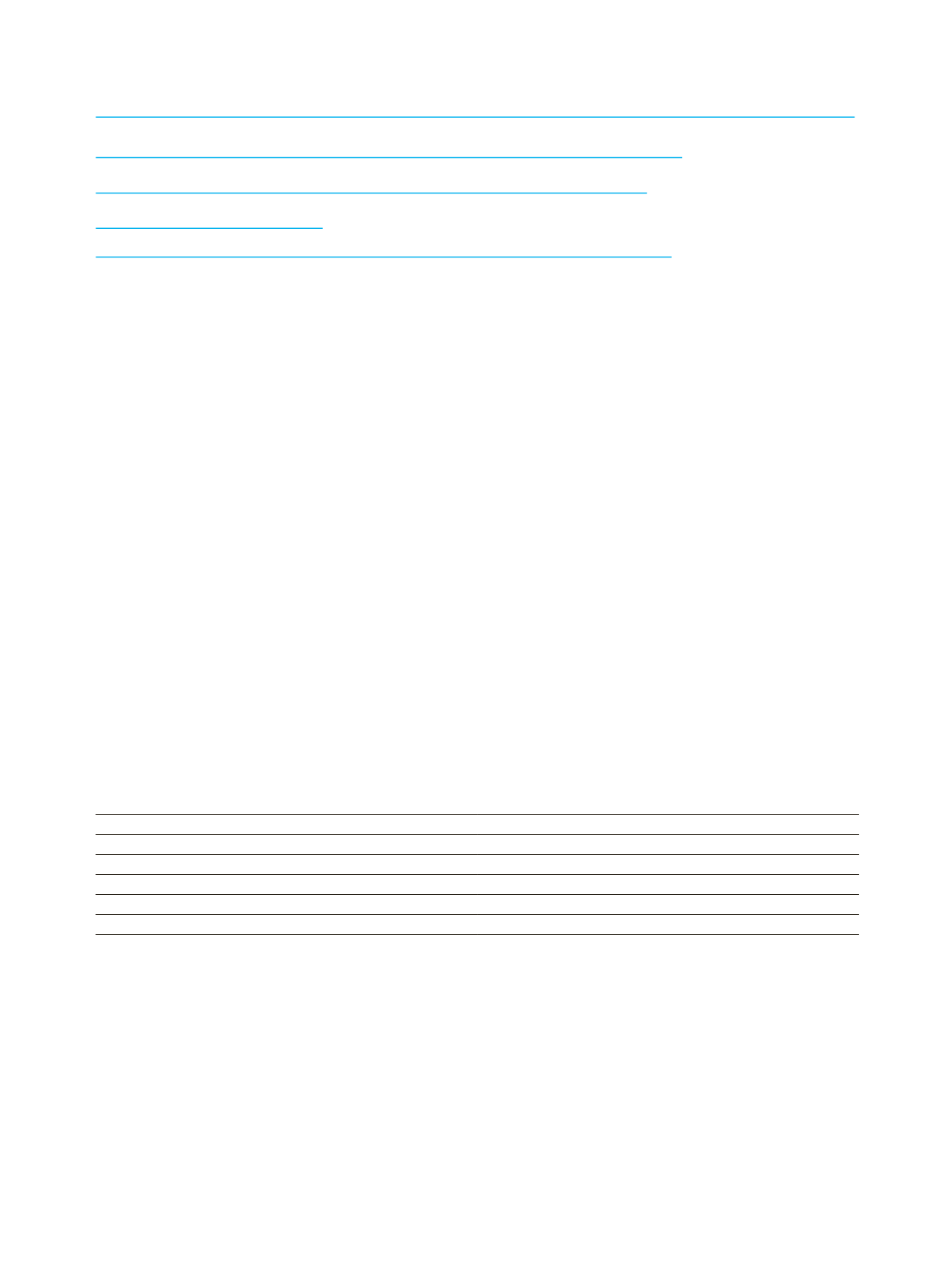

12. Information on 20% of other accounts in income statement, if other accounts exceed 10% of total income

statement.

Other accounts which exceed the 10% of the income statement ,other than other operating income and other

operating expense, amounting to TL 28,928 (31 December 2014: TL 28,505) consist of transfer commissions, letter of

credit commissions and other.

Current Period

Letter of Credit Commissions

24,187

Transfer Commissions

3,046

Other

1,695

Total

28,928

V. INFORMATION AND DISCLOSURES RELATED TO STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

1. Changes due to revaluation of financial assets available-for-sale

None.

2. Increases due to cash flow hedges

None.

3. Confirmation on exchange rate differences between beginning and ending

None.