147

FINANCIAL INFORMATION

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I OF SECTION THREE

ARAP TÜRK BANKASI ANONİM ŞİRKETİ

NOTES TO UNCONSOLIDATED FINANCIAL STATEMENTS

AT 31 DECEMBER 2015

(AMOUNTS EXPRESSED IN THOUSANDS OF TURKISH LIRA (“TL”) UNLESS OTHERWISE STATED. )

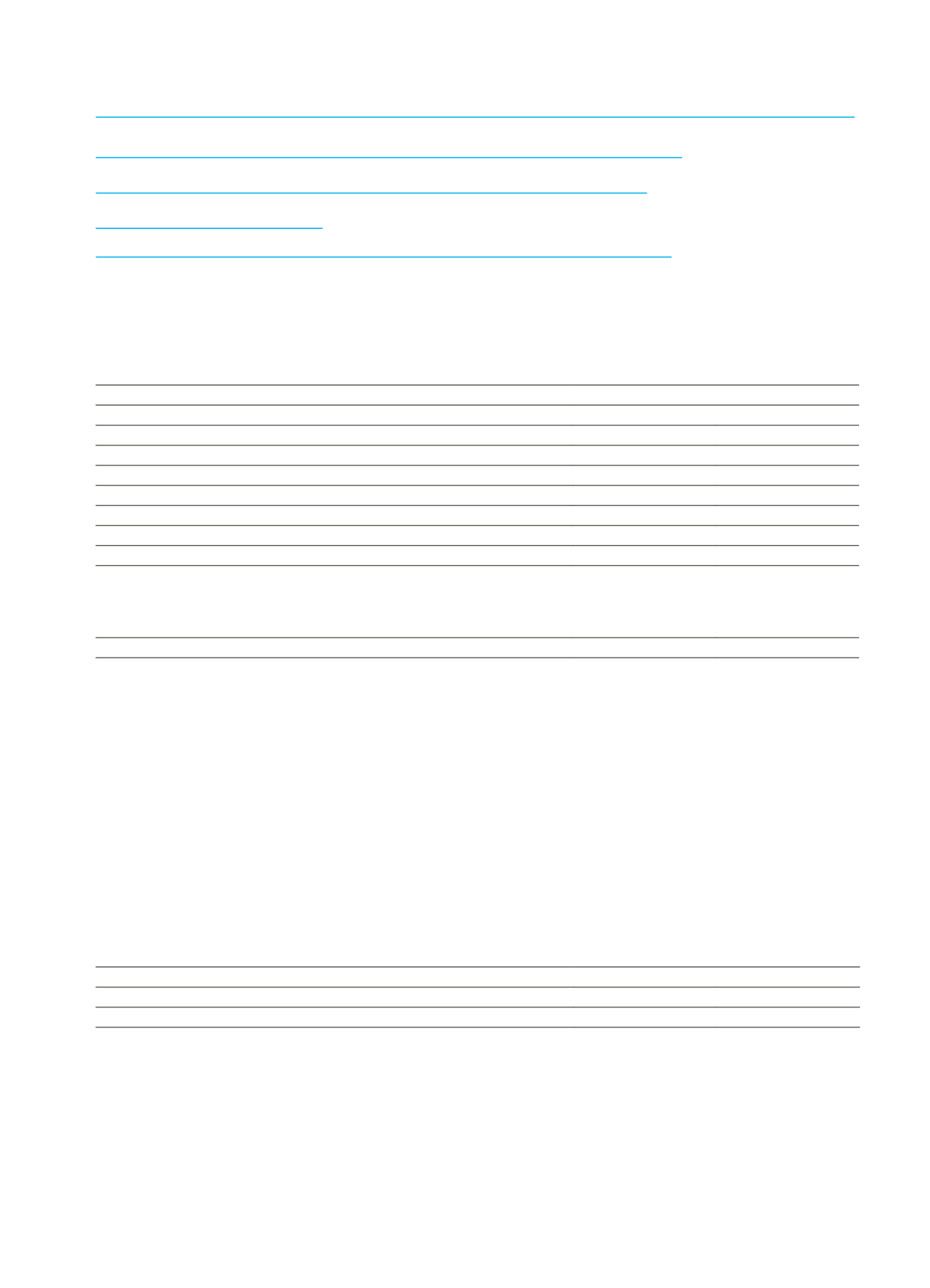

7. Information on provisions

Information on general provisions

Current Period

Prior Period

Provisions for Loans and Receivables in Group I

15,007

15,004

Additional provisions for the loans with extended payment plan

-

-

Provisions for Loans and Receivables in Group II

227

-

Additional provisions for the loans with extended payment plan

-

-

Provisions for Non-Cash Loans

4,836

4,680

Other

-

-

Total

20,070

19,684

Provisions for currency exchange gain/loss on foreign currency indexed loans

Current Period

Prior Period

Foreign Exchange Provisions for Foreign Currency Indexed Loans

(*)

136

30

(*)

Foreign exchange differences of foreign currency indexed loans are netted off with loans.

Special provisions set aside for non-funded and non-cash loans

As of 31 December 2015, special provisions set aside for non-funded and non-cash loans amounting to TL 1,520 (31

December 2014: TL 1,547).

Reserve for employee termination benefits

The Bank reserved for employee severance indemnities in the accompanying unconsolidated financial statements using

actuarial method in compliance with the updated “TAS 19 - Employee Benefits”. Accumulated all actuarial gains and

losses in equity are recognized in other capital reserves.

As at 31 December 2015 and 31 December 2014, the major actuarial assumptions used in the calculation of the total

liability are as follows:

Current Period

Prior Period

Discount Rate

3.12%

2.84%

Expected Rate of Salary/Limit Increase

7.56%

5.00%

Estimated Employee Turnover Rate

5.30%

5.44%

In accordance with existing Turkish Labor Law, the Bank is required to make lump-sum termination indemnities to each

employee who has completed one year of service with the Bank and whose employment is terminated due to retirement

or for reasons other than resignation or as mentioned in related legislation. The computation of the liability is based

upon the retirement pay ceiling announced. The applicable ceiling amount as at 31 December 2015 is TL 3,828 (full TL)

(31 December 2014: TL 3,438 (full TL)). Reserve for employee termination benefits are calculated via net present value

of estimated provision of probable liabilities will be arised in the future and reflected in the financial statements.